By James Crombie

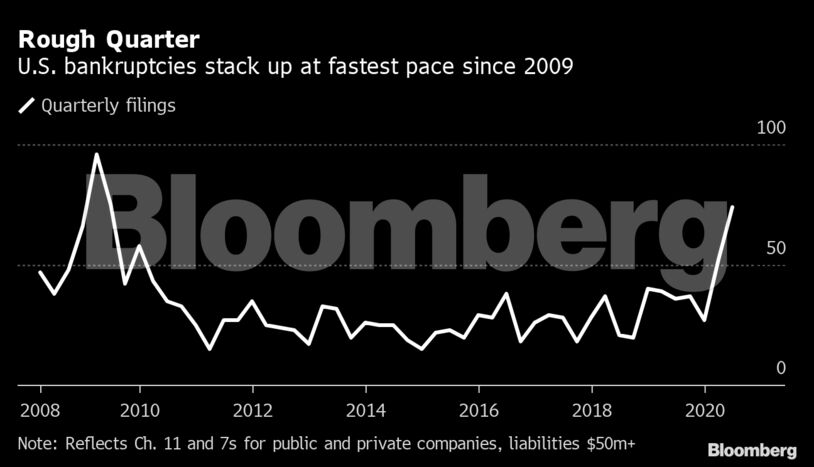

Three retailers filed last week, including Grupo Famsa SAB de CV, CEC Entertainment Inc. and GNC Holdings Inc. That made 16 bankruptcies for the year-to-date, the most ever for the first six months of a year, according to Bloomberg data going back to 2003.

The sector remains under pressure from lockdowns that are crushing demand. Cirque du Soleil Entertainment Group — one of the best-known brands in live performance — filed for protection from creditors in Canada Monday.

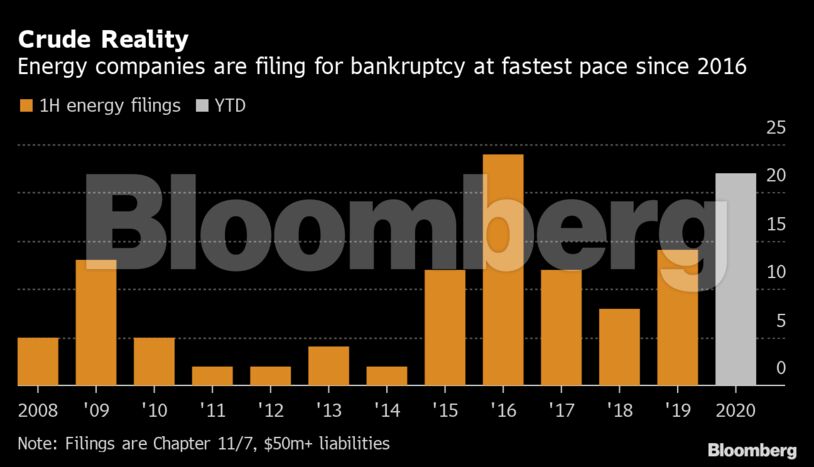

The energy sector is the second-biggest contributor to this year’s bankruptcy surge, with June’s seven oil and gas filings matching the April 2016 peak. Chesapeake Energy Corp.’s insolvency highlights risk lurking in the shale sector, which remains under pressure from weak global demand.

Lilis Energy Inc., a Permian basin oil and natural gas producer, filed for bankruptcy protection, citing pressure from the Covid-19 pandemic. Exploration and production company Sable Permian Resources LLC also filed.

California Resources Corp. got an extension until June 30 to make interest payments originally due May 29. And Seadrill Ltd. is considering bankruptcy in the U.S. as one option for its upcoming debt restructuring.

Almost a third of U.S. shale producers are technically insolvent with crude at $35 a barrel, Deloitte LLP said in a study. High-yield exploration and production companies saw reserve-based loans cut after their spring redetermination, according to S&P Global Ratings.

Trouble Brewing

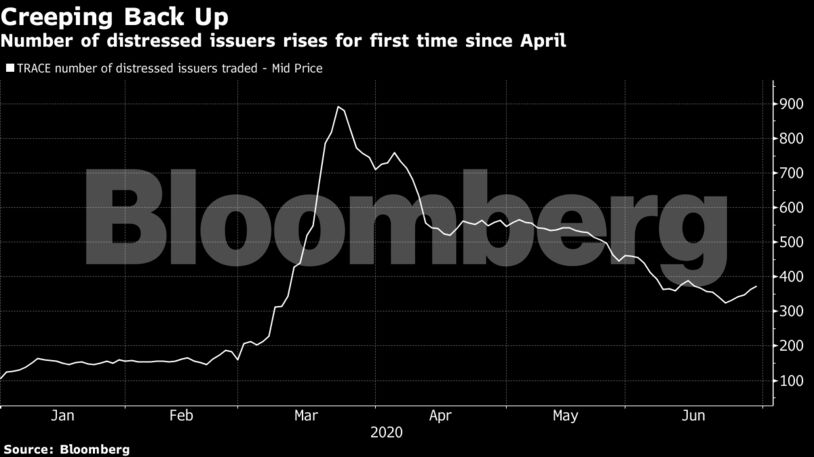

The amount of distressed bonds and loans outstanding rose to $348 billion as of June 26, a 1.2% increase since June 19 but down significantly from the $544 billion trading on May 15, data compiled by Bloomberg show. The distressed bond universe grew 3% while leveraged loans contracted by 2.3%.

There were 686 distressed bonds from 372 issuers as of June 29, compared with 1,896 issues from 892 companies at the March 23 peak.

Click here for a worksheet of distressed bonds and loans

The number of corporate issuers in the U.S. and Canada rated CCC+ has jumped to 256 from 132 since the start of February, S&P Global Ratings said in a report Monday.

“Issuers in the CCC category have an unsustainable capital structure and therefore are particularly vulnerable to default,” said Sudeep Kesh, head of S&P Global Credit Markets Research. “Their historical default rates from 1981 through first-quarter 2020 are 11 times higher than those in the B category.”

AMC in Focus

Bombardier Inc. and American Airlines Inc. topped the ranks of issuers with the most debt trading at distressed levels that hadn’t filed for bankruptcy as of June 26, data compiled by Bloomberg show. Also on the list is AMC Entertainment Holdings Inc. — the largest U.S. cinema chain — which pushed back reopening its theaters to July 30, two weeks later than planned.

| Company | Debt ($B) |

|---|---|

| Bombardier Inc | 8.7 |

| American Airlines Inc | 7.0 |

| Envision Healthcare Corp | 6.4 |

| Transocean Inc | 6.2 |

| Mallinckrodt International Finance SA | 4.4 |

| AMC Entertainment Holdings Inc | 4.2 |

| Noble Holding International Ltd | 3.4 |

| Team Health Holdings Inc | 3.4 |

| Crown Finance US Inc | 3.4 |

| CHS/Community Health Systems Inc | 3.4 |

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS