By Sharon Cho and Grant Smith

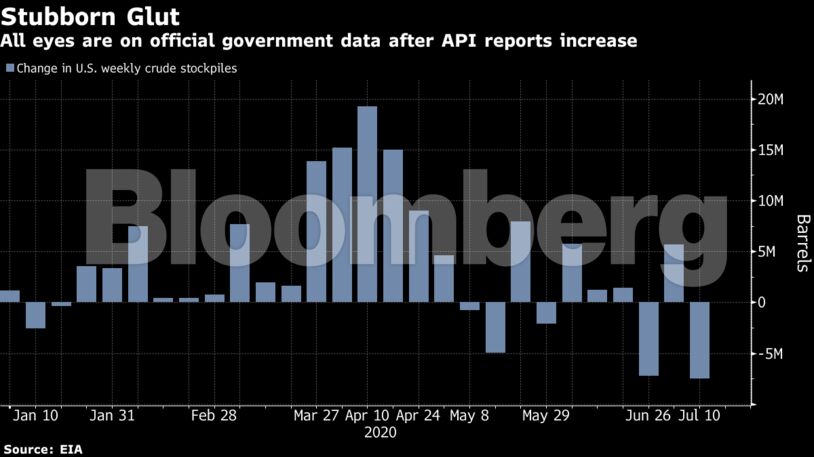

The American Petroleum Institute reported crude inventories rose by 7.54 million barrels last week, according to people familiar with the figures, which would be the biggest increase since May if confirmed by government data on Wednesday. Meanwhile, President Donald Trump warned that the coronavirus outbreak in the U.S. will probably worsen before improving.

Oil surged Tuesday after European Union leaders agreed on a giant stimulus package to pull their economies out of the worst recession in memory, while signs that the first virus vaccine may be approved this year added to positive sentiment. Crude remains in a fairly narrow range near $40 a barrel as investors weigh surging coronavirus cases and the return of supply by OPEC+ after historic cuts.

“Everything seemed to rise in the commodity world yesterday as part of the reflation trade,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich. “But today oil fundamentals are taking control again, and a likely crude inventory build in the U.S. doesn’t fit in the story of an undersupplied market.”

| Prices |

|---|

|

U.S. crude stockpiles at the key storage hub of Cushing increased by 716,000 barrels last week, while gasoline inventories fell for a third week, according to the API. Analysts expect the Energy Information Administration to report a 2.2 million-barrel decline in nationwide crude stockpiles, according to the median estimate in a Bloomberg survey.

OPEC+ is due to start resuming some supplies next month, tapering the record production cutbacks implemented to offset demand losses inflicted by the coronavirus. Nonetheless, there are signs the alliance will be careful.

Russian shipments of its flagship Urals grade look like they might dip, according to loading programs seen by Bloomberg for the nation’s three main western oil ports. Meanwhile, Saudi Arabia is set to burn potentially record amounts of crude to run its power plants and keep its citizens comfortably air-conditioned over the peak summer months of July and August.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS