By Alex Longley and Sherry Su

The nation’s Urals crude, the main export grade, is fetching premiums of about $2 per barrel to benchmark prices in Northwest Europe, the highest in at least a decade, according to traders who participate in the market. Just weeks ago it was being discounted by $5. Huge cuts to Russia’s seaborne export programs, deep output reductions from other producers have also helped. Rebounding Chinese demand has further boosted the global market for the type of oil that Russia pumps.

Russia and several other OPEC+ nations are set to meet in the coming days to decide whether to prolong the deepest round of oil production curbs ever in response to a demand slump caused by the coronavirus. It appears they favor a one-month extension, taking the current agreement to the end of July. Many of the grades that have been curtailed worldwide are what traders call medium-sour barrels, meaning they’re of average density but relatively high in sulfur.

“As you strip out Russian medium sours, the cuts in the Middle East are all cutting many of the alternatives,” said Kit Haines, an analyst at consultant Energy Aspects Ltd. That means there’s “not much baseload crude around for European refiners and, if your margin is positive, you’ve got to buy.”

Low Flow

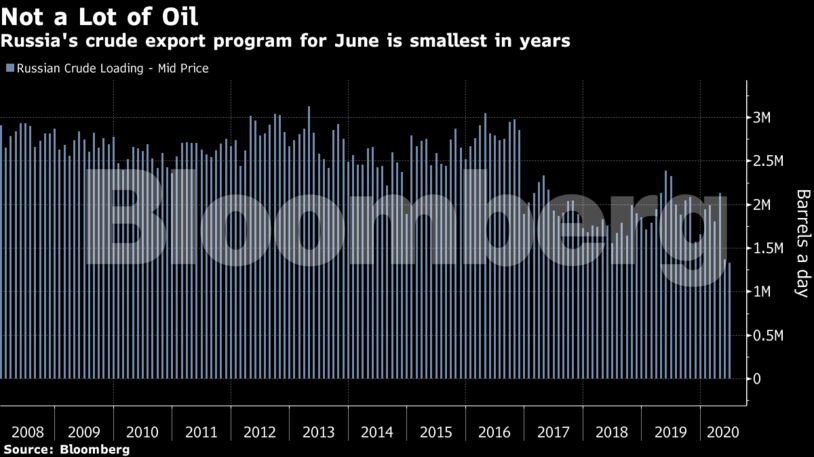

Russia exports its crude via two main channels: directly via pipeline and also on tankers from ports in the Far East, the Baltic and the Black Sea. The seaborne exports are the most visible part of Russian shipments and Moscow appears to have concentrated its cuts there, maximizing their impact on the physical market.

Russia is currently scheduled to ship 1.33 million barrels a day of Urals crude from its ports this month, according to loading programs seen by Bloomberg. If it turns out that way — and the country may yet add a few more cargoes to the schedule — then that would constitute the smallest outflows in at least a decade. To put that in context, the country was shipping in excess of 3 million barrels a day at one stage back in 2013.

Oil prices have rallied from historic lows since the Organization of Petroleum Exporting Countries and its allies implemented deep production cuts from May 1. With a tentative recovery in oil demand as the world emerges from the coronavirus lockdown, the cartel must now decide how long to maintain tight limits on output.

Under the current output curbs, Russia is required to restrict output by 2.5 million barrels a day in May and June. The wider OPEC+ measures remove a total of 9.7 million a day.

Urals crude has quite a heavy fuel oil content by industry standards. Normally used by ships and in power stations, the fuel typically sells at deep discounts to crude. The output restrictions have limited fuel oil supplies and boosted prices, lending further support to the price of the Russian barrels.

Urals for delivery in Rotterdam, a European oil hub, is trading at the highest premium to the Dated Brent benchmark since at least 1990, according to price reporting agency Argus.

“Strength for the Russian crude markets is a reflection of the OPEC+ supply cuts working, supported by some continued Asian demand,” said Olivier Jakob, the managing director of PetroMatrix GmbH. “Russian differentials were the first to react to the supply cuts, followed by the other OPEC+ nations.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS