By Hailey Waller

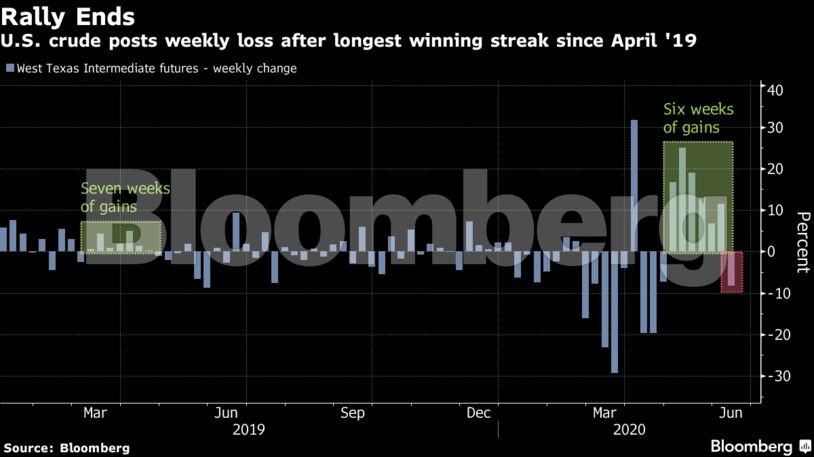

While crude has pushed higher from a historic crash below zero in April — buoyed by OPEC+ production curbs that began in May — the market largely shrugged off the alliance’s recent move to extend those cuts.

“The past 24 hours have highlighted the perils of underestimating the economic fallout of the Covid-19 pandemic and the threat of fresh lockdowns,” said PVM Oil Associates analyst Stephen Brennock. “This isn’t the first and won’t be the last time that markets are guilty of complacency.”

Any recovery in crude will be largely dependent on a consumption comeback. Barclays Plc predicts the market has already seen the fastest improvement in demand and steepest drop in supply. Meanwhile, Mercuria Energy Group Ltd. Chief Executive Officer Marco Dunand said this week that global crude consumption will return to about 95 million barrels a day by December, unless there is a significant second wave of coronavirus infections.

“We’re going to be stuck in this range between $35 and $40 a barrel,” said Andy Lipow, president of Lipow Oil Associates LLC in Houston. Breaking out is a matter of “how many additional virus cases prevent us from increasing demand.”

Likely adding to the pressure on crude was the record withdrawal Thursday from one of the largest exchange-traded funds in the oil market. WisdomTree’s WTI Crude Oil ETF had a little over $128 million worth of outflows, according to filings.

| Prices |

|---|

|

Optimism at the start of the week over the agreement by the Organization of Petroleum Exporting Countries and its allies to extend curbs by a month quickly diminished after Saudi Arabia said it would cease extra voluntary cuts at the end of June. The deal even secured commitments from laggards such as Iraq and Nigeria after they were called out for their non-compliance.

| More Oil News |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein