By Sharon Cho and Alex Longley

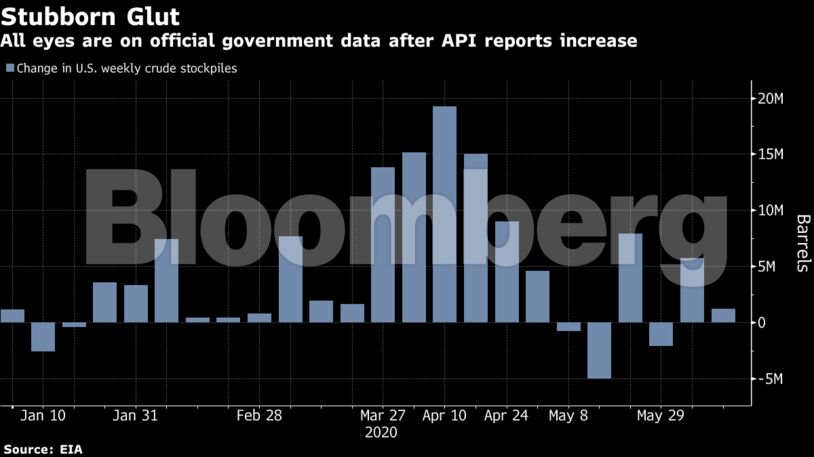

Futures dropped 2.2%, falling for a second session. The American Petroleum Institute reported that inventories rose by 1.75 million barrels last week, according to people familiar with the data. That would be a third weekly gain if confirmed by government figures on Wednesday. Coronavirus cases are also surging again in many American states, threatening a nascent recovery in fuel demand.

Some of the recent strength in physical crude markets is also waning. Differentials for crude from Europe to the U.S. Gulf Coast have struggled to build on earlier gains. The global Brent benchmark has slumped back into a contango structure, which signals oversupply. Key swaps markets that traders use to hedge prices have also weakened.

While oil has rallied from the depths of the crisis in April and early May, the threat from the virus remains acute. The U.S. government’s top infectious-disease expert, Anthony Fauci, said Tuesday he’s seeing a “disturbing surge” in new cases.

While the “focus lies on the inventory data,” there’s also persistent anxiety around the growth of the pandemic, said Hans van Cleef, senior energy economist at ABN Amro. “Hopes for a rise in demand are counterbalanced by fears regarding new Covid-19 spread.”

| Prices |

|---|

|

Newly diagnosed virus cases and other indicators of the pandemic’s spread have soared in hot spots across America. Infections are growing in Texas, Florida, Arizona and in California. Still, American gasoline demand has now returned to about 80% of where it was last year, according to IHS Markit.

See also: Top Oil ETF Accused of Risk-Disclosure Flaw Amid Market Rout

Anxiety over trade also weighed on the market, with the U.S. mulling new tariffs on $3.1 billion of exports from France, Germany, Spain and the U.K., adding to an arsenal of measures against the European Union that could spiral into a wider transatlantic trade fight later this summer.

There are also signs that some funds could be pulling out. Trend-following funds that follow technical signals are nearing levels where they would reverse their current bullish positions, according to Keith Wildie, senior commodities broker at R.J. O’Brien.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS