By Ann Koh and Alex Longley

In oil, there are warning signs that any recovery will be long and slow. The research unit of state-owned China National Petroleum Corp. said fuel demand in the country will drop by 5% this year. India’s consumption may not recover to pre-coronavirus levels for months.

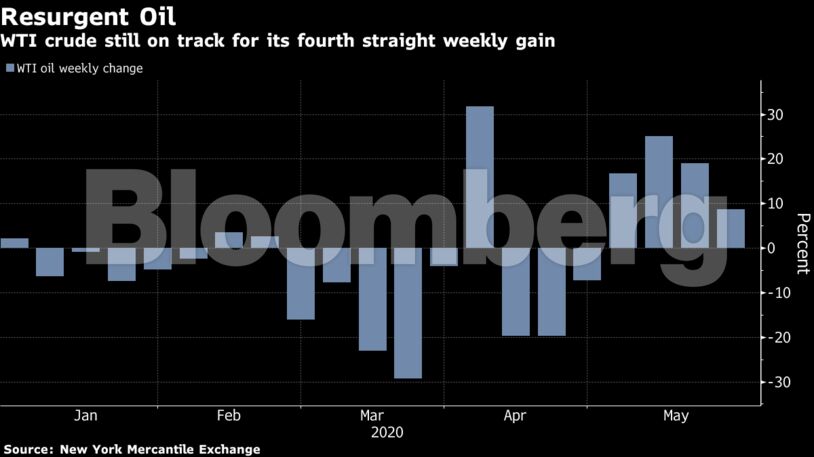

Still, the market is in much better shape than even a couple of weeks ago. Futures prices are heading for a fourth weekly gain with supply and demand starting to rebalance, while physical barrels have also rallied. American drillers are in the process of curtailing 1.75 million barrels a day of existing production by early June, according to IHS Markit.

“Although there is reason for the high levels, a constant increase is not sustainable or justified,” said Paola Rodriguez Masiu, senior oil market analyst at Rystad Energy. “The market situation is definitely better than a few weeks ago, supply has been curtailed significantly one way or another and demand has also started to recover.”

| Prices: |

|---|

|

China’s oil demand earlier this month was probably at 92% of levels at the same time last year, IHS Markit said separately, and full-year consumption is likely to be around 8% lower than in 2019. Independent refineries have boosted their processing back to record highs, according to SCI99.

Meanwhile, output cuts by major producers have been building up and stockpiles have been eroding. Inventories at the U.S. storage hub at Cushing, Oklahoma, shrank by the most on record last week.

| More oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet