By Elizabeth Low and Alex Longley

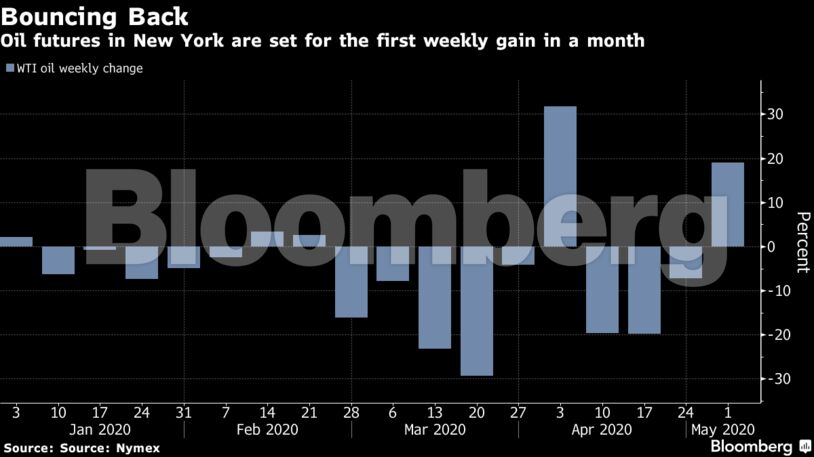

Futures in New York rose to near $20 a barrel on Friday and are up about $3 this week. U.S. oil majors are announcing major production closures, with Exxon Mobil Corp. and Chevron Corp. planning to shut output following ConocoPhillips curtailments on Thursday. OPEC+ officially started its unprecedented 9.7 million barrels a day of output reductions on Friday.

The price of real crude is reacting to the curbs, with key grades from the Caspian to the North Sea trending higher in recent days. Oil is being helped along by signals that the worst of the demand destruction may have passed. U.S. government data showed gasoline consumption rose by the most in almost a year last week, while rush-hour traffic in some of the biggest cities in China has recovered to pre-virus levels.

“We started last month with a focus on demand destruction and now we’re starting this month with a focus on the supply reduction,” said Olivier Jakob, managing director of consultant Petromatrix GmbH.

Still, the industry is nowhere close to being out of the woods as a massive glut persists. Royal Dutch Shell Plc on Thursday forecast that its refineries won’t run at more than 70% of their capacity in the current quarter. Turkey will halt a 238,000 barrels a day plant as a result of the slowdown in demand. Global storage is also close to filling up and Citigroup Inc. warned the worst is likely yet to come for the oil market.

| Prices: |

|---|

|

Since crude plunged into negative territory last week, investors have been fleeing the nearest futures contracts, increasing volatility. The United States Oil Fund LP, which came under pressure from regulators last month due to the size of its WTI position, said on Friday that it will halve holdings in the July contract. The fund earlier said it may expand investments to include products beyond the benchmark New York crude grade.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire