By Liam Denning

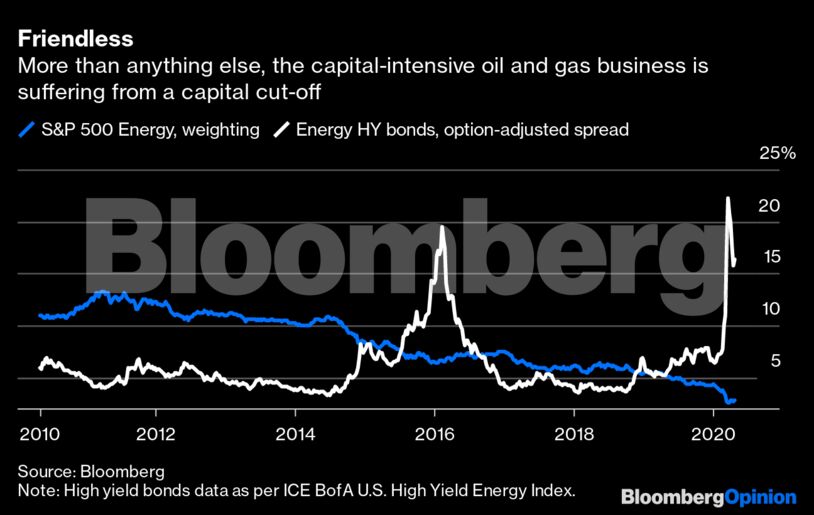

Those investors who hung on will feel the predictable mixture of fear, frustration and embarrassment. They’ll soon be joined or replaced in some instances by a new cohort: bondholders ending up with equity stakes they didn’t expect. The result, says Dan Pickering, Chief Investment Officer at Pickering Energy Partners Inc., is that “companies will wind up in a more adversarial relationship with owners than they had in the past.” Repairing that relationship, which ought to have been a priority anyway, is now a matter of life or death.

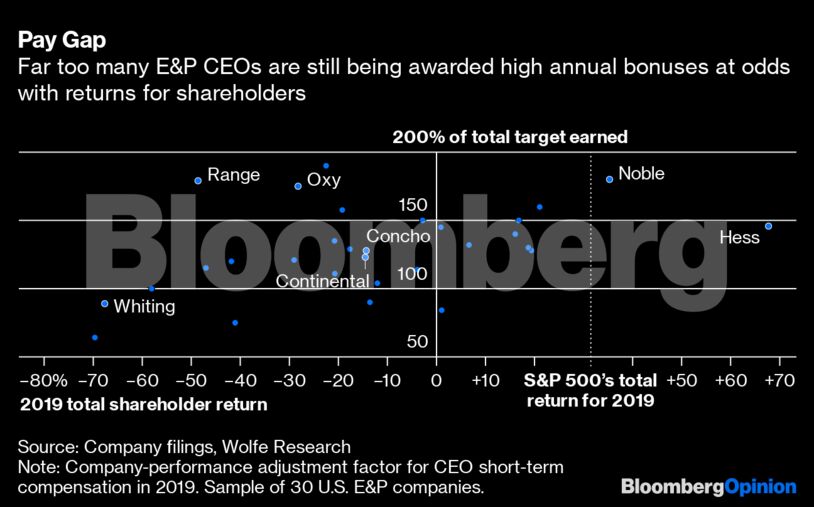

Doing so begins with management, and the raft of proxy statements just released aren’t encouraging on that front. Executive pay and shareholder returns still occupy alternate realities. Of 30 companies I sampled, fully 16 awarded above-target bonuses to the CEO despite negative returns to shareholders last year. Another seven got them for returns that, while positive, lagged the S&P 500.

In rating their returns against each other, rather than the market, E&P companies keep c-suite pay afloat while their stocks all sink together. Covid-19 makes this circular logic even more damaging. All industries will seek to rebuild after this crisis and compete for scarce capital from burned investors in order to do so. A reputation for benchmarking itself against dross — and with a decade of terrible returns to show for it — will have the E&P industry starting somewhere near the back.

More than changes to this or that figure, therefore, E&P companies must communicate a change in attitude. Generalist investors nonplussed by oil and then burned by the Covid-19 crisis will require more than a 12-month budget with some price sensitivities thrown in to tempt them back. The specifics will be different for each firm, but the underlying ethos should be the same: Stop spending money you don’t have on producing energy nobody wants.

Throttling back spending not only leaves more money for payouts or cutting debt, it reins in supply. The unprecedented drop in oil demand due to Covid-19 is forcing this, of course. But too many unprofitable barrels were spewing from shale anyway. Kimmeridge Energy Management Co., an activist fund manager, estimates more than 80% of the increase in U.S. oil and gas production in the decade after 2008 was funded with external capital, much of it incinerated in the process.

CNX Resources Corp. took a new approach with its earnings call Monday. A year ago, the Appalachian gas producer was touting plans to raise spending and accelerate drilling — and the stock took a beating. This time, it’s all free cash flow twinned with plans for flattish spending and production right through the middle of the decade. Donald Rush, CNX’s finance chief, made the salient point that “if E&P companies are forced to use their own money to fund their own cash needs, [oil and gas] prices will rise to support that.” CNX was the best performing E&P stock Monday, up 12%.

Demonstrating commitment to this will take time. Storage tanks are still filling, and Pickering suggests a bottoming process for the sector could take two to five years, not quarters. The objective must be stronger balance sheets and a focus on rewarding investors rather than growth at all costs. This, in turn, would leave E&P firms better able to meet the challenges, and higher risk premiums, of a volatile oil market and intensifying environmental pressure. Capital restraint, meeting the market on its own terms, is the key.

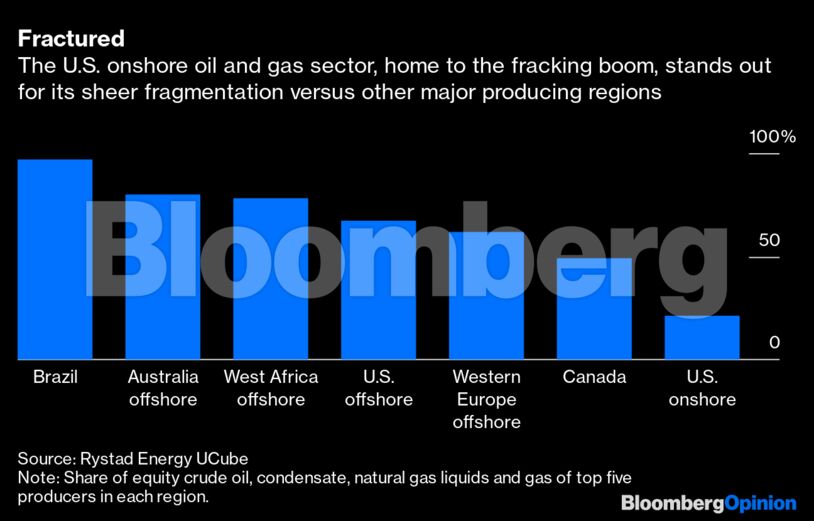

Consolidation has an essential role to play in that. No management team will use an earnings call to kick off a sales process. Making it clear they’re open to deals and the board isn’t racing to adopt poison pills would help, though. Fracking is just too fragmented.

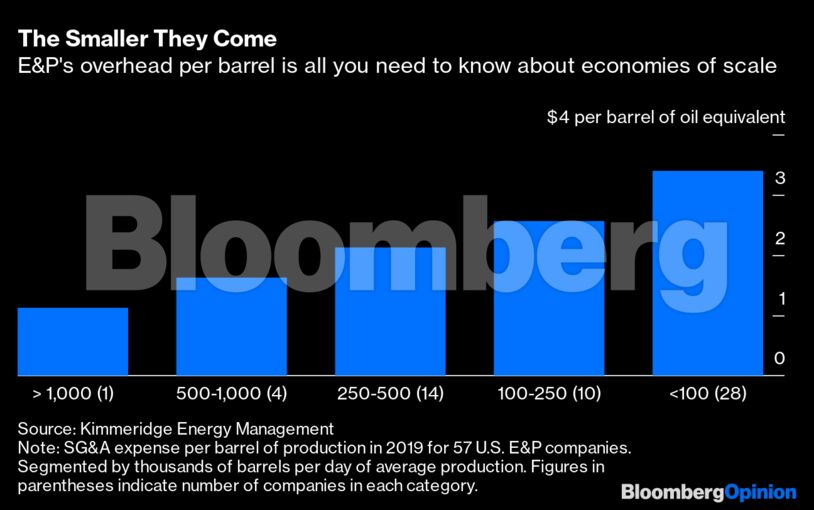

Surveying 57 E&P companies representing 12.3 million barrels of oil equivalent a day of output, Kimmeridge calculates their SG&A expenses added up to $9.3 billion in 2019. Per barrel, the spread between smaller and larger companies is wide. For example, the biggest, ConocoPhillips, produced more oil and gas than the 28 smallest companies combined. But Conoco spent $556 million on SG&A versus their collective $1.53 billion.

Taking the 38 firms producing 250,000 barrels-equivalent a day or less each, SG&A averages $2.93 a barrel. Cutting that to $1.50, on a par with the top five, would save $1.5 billion. If that sounds like pocket change, then you’re forgetting how small these companies are. Set it against their combined market cap of just $18 billion, and it’s an 8% cash yield.

Various actors hoping to stave off restructuring with some taxpayer-funded deus ex machina often wrap their self-interest in tropes of energy dominance. But they have it backwards. The U.S. does have a vested interest in a healthy oil and gas sector that doesn’t rely on implicit subsidies such as rampant gas flaring. As Pickering puts it: “Beneath all this is a patient that needs to be saved.” But that means curbing the sector’s worst impulses and prioritizing efficiency.

A Soviet-style fetish for sheer oil and gas production will ultimately make the industry a ward of the state and do irreversible damage to our planet in the process. As the earnings calls play out, listen for those companies that accept things can’t just go on as they were, and the ones insisting they must.

— “Pay Gap” chart by Elaine He

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS