By Alex Longley

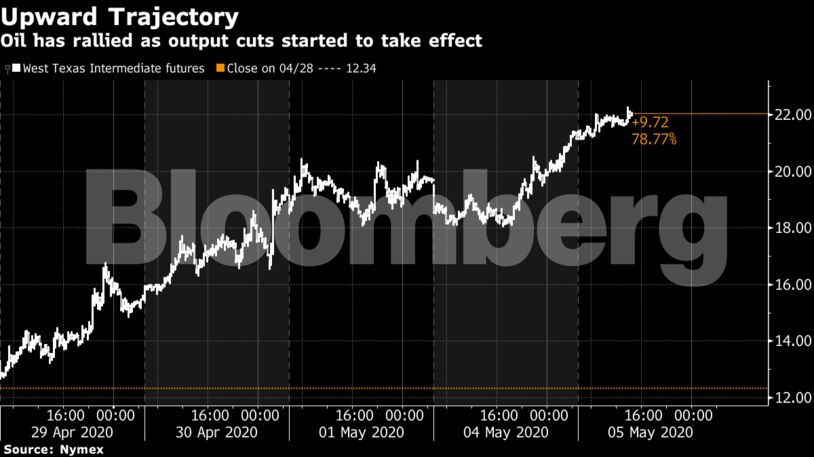

Futures in New York rose for a fifth day, with OPEC+ producers and Texas drillers slashing output. On Tuesday, Genscape reported an increase in inventories of only 1.8 million barrels at Cushing, Oklahoma, the delivery point for West Texas Intermediate crude. That would be the smallest weekly gain since mid-March if confirmed by official data due Wednesday.

The American crude benchmark has more than doubled from an intraday low near $10 a barrel last week as production curbs take effect. While OPEC and its allies have committed to remove 9.7 million barrels a day, U.S. giants Exxon Mobil Corp., Chevron Corp. and ConocoPhillips plan a combined reduction of as much as 660,000 barrels a day by the end of June.

There are also early signs that the plunge in fuel consumption caused by the spread of the coronavirus might have bottomed out in some markets, prompting U.S. President Donald Trump to tweet on Tuesday: “Oil prices moving up nicely as demand begins again!”

While demand remains well below supply and clearing the glut will take time, Norwegian bank DNB ASA also sees rebalancing coming.

“We are currently seeing accelerating oil-production curtailments outside the OPEC+ countries,” said DNB analyst Helge Andre Martinsen. “Even though the oil-market balance still looks quite oversupplied in the very short-term, we believe this is about to change quite quickly.”

| Prices: |

|---|

|

As supply concern starts to ease, the discount on U.S. oil for June delivery relative to July has narrowed to the least in a month.

In oil options markets, sentiment is also starting to improve. The premium of bearish put options over bullish calls is heading for its smallest close since early March, a sign of diminished pessimism among investors.

Nevertheless, a substantial glut of crude remains, with supplies from the Middle East soaring to their highest level since at least January 2017 last month.

Saudi Arabia, Iraq, Kuwait and the U.A.E., which account for about 70% of OPEC’s production, shipped a combined average of 18.9 million barrels a day of crude and condensate in April, tanker-tracking data compiled by Bloomberg show. That’s 2 million barrels a day more than revised March levels.

| More oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran