By David Wethe

Whiting’s bankruptcy filing alone has undercut rig operators, water haulers, chemical providers and other contractors large and small. Four of the world’s biggest servicers are each owed more than $1 million, with Schlumberger Ltd. and Halliburton Co. carrying unsecured claims of more than $8 million a piece.

Investors will get their first look at the first-quarter financial damage on Friday when Schlumberger, the world’s biggest oil services provider, reports earnings. Halliburton and Baker Hughes Co. will follow next week.

On Monday, Baker Hughes announced it will write down $15 billion in value from two of its biggest business units. That followed announcements over the past month from rivals Schlumberger and Halliburton of furloughs, salary reductions and job cuts.

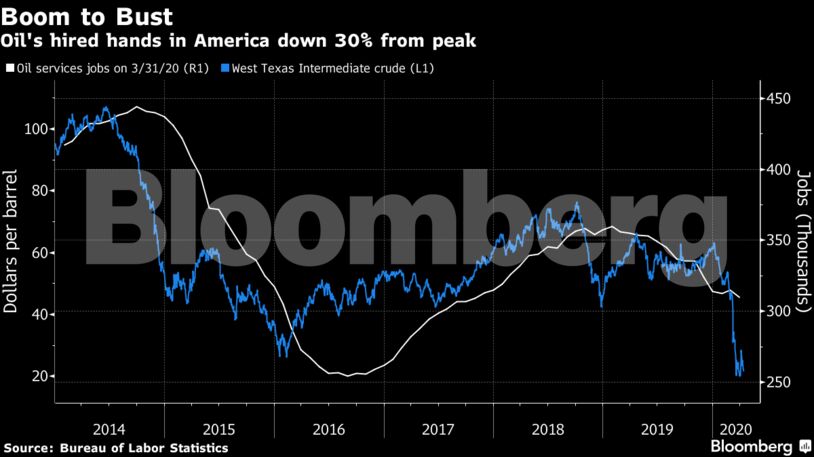

After averaging less than three bankruptcies a quarter for all of 2018 and the first half of 2019, the oilfield services sector finally hit its debt wall, according to Haynes & Boone LLP. Now the hired hands of the oil patch are averaging more than eight filings over each of the past three quarters.

“I think we’re going to have quite a few bankruptcies this go around,” Locke said by telephone. “Our experience in the Bakken, after 15-20 years up there is probably over for drilling, which is really really sad.”

To combat that, some explorers such as Parsley Energy Inc. have have asked their contractors to help them cut as much as 25% from their oilfield costs. But industry consultant Rystad Energy estimates that explorers may only be able to get about half that, with so little for the servicers to give up this time around.

The last time that oil prices tanked, from more than $100 a barrel in 2014 to roughly $26 in 2016, service companies gave up major concessions to their customers, partly to keep market share. Now companies such as Patterson-UTI Energy Inc. and RPC Inc. are working from a new playbook: scrapping excess frack pumps for the first time ever, turning instead to idle gear in a pinch.

“When a pump breaks, I drag the truck off to the side and I go grab another one that was working last time I had it on a job, put it in line and run that till it breaks,” Richard Spears, an industry consultant who’s worked in and around the oil patch for decades, said on a recent Evercore ISI webinar.

“You can do this incredible discounting as long as you’ve got idle equipment that was in good shape,” he said. “But eventually you burn through even all that.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein