By Saket Sundria and Alex Longley

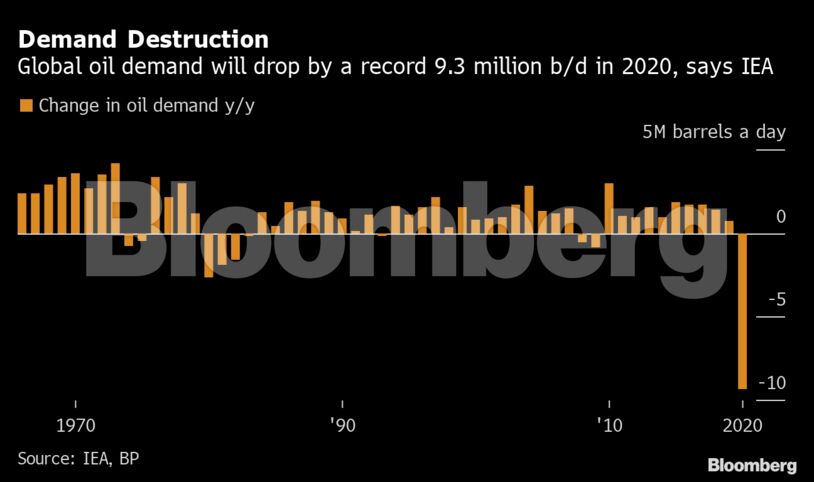

The stockbuilds come as consumption falls off a cliff amid lockdowns globally to curb the spread of the coronavirus outbreak. The International Energy Agency said Wednesday that output cuts by OPEC+ won’t counter the drop off in demand, adding that 2020 may come to be known as the worst year in the history of the oil market. All the while physical oil prices, particularly in Europe, are trading far below those of futures.

“What will be the most important determinant for oil markets in the short term is how quickly governments relax social distancing measures,” boosting consumption, said Rystad Energy AS’s head of analysis Bjornar Tonhaugen.

| Prices: |

|---|

|

The physical oil market is also showing signs of strain. Key North Sea crude swaps are trading at the biggest discount to the headline Brent futures price in almost a decade. The critically important Dated Brent benchmark, which shapes the price of millions of barrels, was assessed at $20.65 on Tuesday, with cargoes across Europe trading at a discount to that value.

Indian refiner Bharat Petroleum Corp. is seeking to cut its crude oil imports from Saudi Arabia by half in May as the world’s biggest lockdown hurts demand for fuel in the country. It follows a plunge in consumption in the U.S. last week that saw gasoline demand at barely 5 million barrels a day.

“Our tanks are almost full, and we also have some cargo already in transit,” Ramamoorthy Ramachandran, director of refineries at BPCL said.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso