By Elizabeth Low and Alex Longley

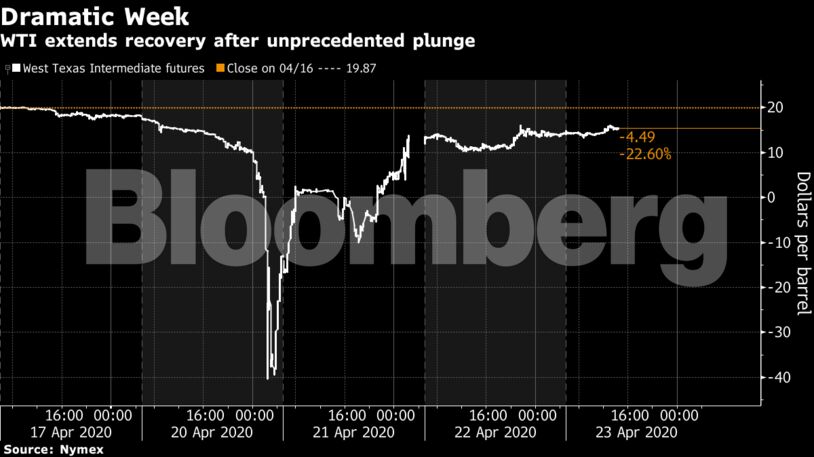

Prices remain down 73% this year, and more production shut-ins are likely as the value of real oil crashes globally. ICE Futures Europe Ltd. confirmed Tuesday that it had taken steps to prepare for negative Brent pricing, while the Chicago Mercantile Exchange took similar measures earlier in the week. Meanwhile, oil traders are rewriting their risk models to accommodate potentially limitless declines.

The OPEC+ coalition agreed earlier this month to slash daily production by about 10 million barrels a day in an effort to reduce the oversupply. The cuts, due to start in May, are slowly being brought forward, with both Algeria and Kuwait saying they’ll now curb output immediately. In the U.S., operators have started shutting wells and halting drilling, steps that could reduce output there by 20% and leave thousands of workers unemployed.

“The oil market is still running with a solid surplus and inventories are building by the day,” said SEB chief commodities analyst Bjarne Schieldrop. “The market is now trading higher in relief, knowing that it is almost a full month until the WTI June 2020 contract is set to roll off.”

| Prices: |

|---|

|

Oil markets are also having to grapple with a wave of volatility spurred by exchange-traded funds. The United States Oil Fund said it may roll more of its WTI contracts forward due to extraordinary market conditions, while the futures division of brokerage INTL FCStone Financial Inc. is limiting the ability of some clients to enter into new trades in the most active oil benchmarks.

Oil’s collapse has also caught out funds from Beijing to Seoul and Mumbai, and caused Chinese banks to suspend new positions on crude products.

Stockpile Gains

U.S. crude stockpiles rose by 15 million barrels last week to 518.6 million, the highest in almost three years, the Energy Information Administration reported. Inventories at the storage hub at Cushing, Oklahoma, swelled by 4.8 million barrels to 59.7 million, taking it closer to its maximum capacity of around 76 million barrels.

There are currently around 34 million barrels of crude in floating storage, with a further 45 million to be loaded onto ships before the end of the month, according to Rahul Kapoor, head of commodity analytics and research at IHS.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS