By Alex Longley

Futures rose by more than $2 in New York to over $14 a barrel. Russian oil companies will cut output by about 19% from February levels, the nation’s Energy Minister, Alexander Novak told the Interfax news agency. Nigeria, which has been struggling to sell its oil even at $10 a barrel, will ship the lowest volume of its key Qua Iboe crude grade since 2016 in May and June.

There have been tentative signs of a recovery in European physical oil markets. Key pricing contracts in the North Sea and Russia have rallied in recent days, though there are still concerns that the world is on the brink of filling its storage capacity. Major producers were due to start output cuts on May 1, but some, including Saudi Arabia, are now curbing output early.

“There is some extra bargain hunting by investors who believe that we may have seen the floor in oil prices,” said Hans Van Cleef, senior energy economist at ABN Amro AV. “Because of the low base, double-digit price gains or declines seem to be the new normal.”

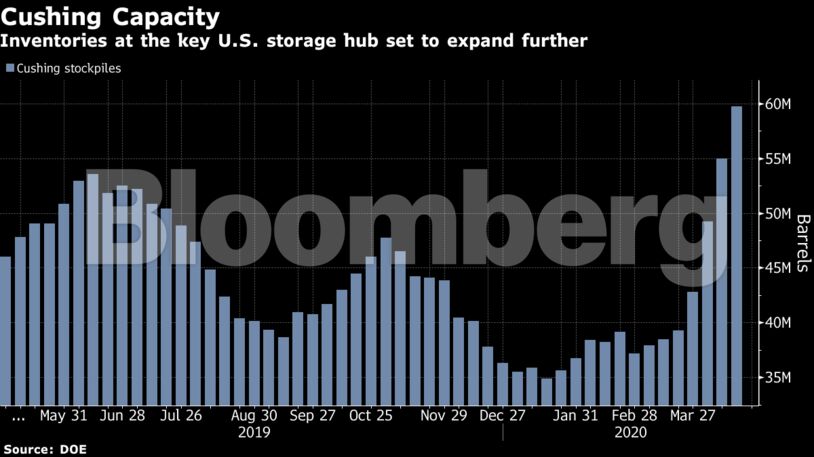

Storage capacity is being tested as a worldwide glut of fuels and crude expands due to coronavirus-led demand destruction. Still, there are tentative signs of a fledgling recovery in demand. Spain’s pipeline operator saw more moderate consumption declines than the previous week, while U.S. gasoline sales rose in the week ending April 18, according to OPIS.

| Prices |

|---|

|

There were renewed signals of the longer-term impact of low prices on Wednesday. CNOOC Ltd. said it will cut its capital spending this year after the collapse in energy markets. In the U.S., pipeline giant Enterprise Products Partners LP cut $1 billion from its capital budget, though it said it hadn’t seen a material change in volumes on its system.

Airlines are fast emerging as a major loser from the downturn. British Airways Plc’s parent International Consolidated Airlines Group said Tuesday it is facing a $1.4 billion charge on fuel and currency hedges, while Finnair Oyj unwound some of its fuel contracts adding an expense of $60 million. Singapore Airlines has also paused its hedging due to substantial losses.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS