By Alex Longley

The outcome “all depends on Russia now,” said Commerzbank AG analyst Carsten Fritsch. “OPEC is building up maximum pressure to join. Today’s meeting was easy; crunch-time comes tomorrow.”

West Texas Intermediate futures for April delivery slipped 8 cents to $46.70 a barrel on the New York Mercantile Exchange as of 9:06 a.m. local time. Brent futures for May dropped 0.3% to $50.99 a barrel on the ICE Futures Europe exchange.

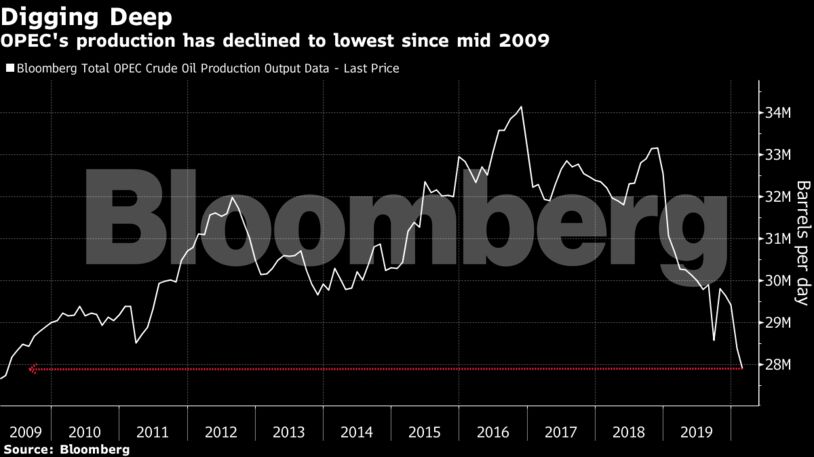

The Organization of Petroleum Exporting Countries agreed it should cut daily crude output by 1 million barrels in the second quarter, with further curbs of 500,000 barrels coming from non-OPEC allies, according to a statement. But Russian Energy Minister Alexander Novak left Vienna on Wednesday without backing such a proposal, and won’t return to negotiations until Friday.

After the talks on Thursday, Iranian Oil Minister Bijan Namdar Zanganeh conceded there’s no plan B if Russia doesn’t agree.

Oil producers are struggling against a weakening demand outlook, the like of which hasn’t been seen in years. When OPEC released its supply and demand model in early February, it pegged global oil-consumption growth this year at 990,000 barrels a day. Now the group sees growth at just 480,000 barrels a day, due to the impact of the coronavirus.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS