By Saket Sundria and Alex Longley

Ministers from the Organization of Petroleum Exporting Countries and its partners gathered in the Austrian capital Friday, but their formal meeting got under way hours behind schedule as Russian and Saudi positions remained entrenched. Russia favors maintaining supply reductions at current levels until June, while the Saudis are pushing for a group cut of 1.5 million barrels a day.

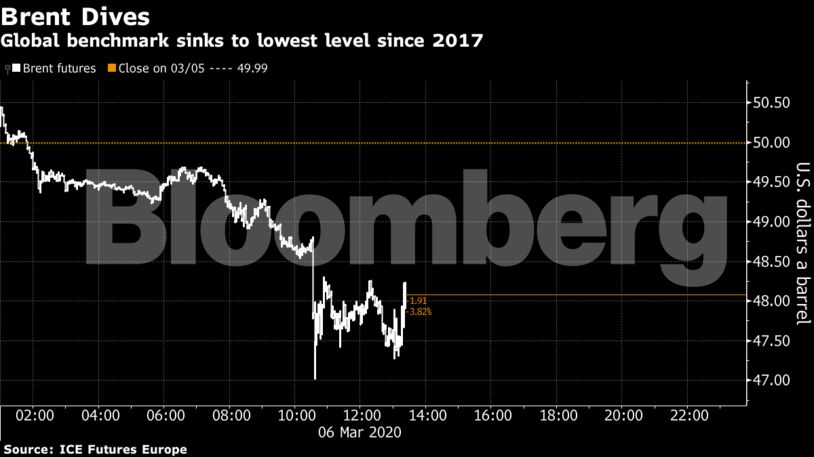

Brent for May settlement fell as low as $47.02 a barrel on the ICE Futures Europe exchange, and traded down 3.3% at $48.33 a barrel as of 2:20 p.m. in London. West Texas Intermediate futures for April delivery lost $1.75, or 3.8%, to $44.15 a barrel on the New York Mercantile Exchange.

Crude has plummeted more than 25% since the start of the year as the coronavirus outbreak roils economies, and a growing number of analysts forecast a contraction in demand this year. Should OPEC and its allies fail to reach an agreement to bolster the market, Saudi Arabia has more to lose than Russia as it needs higher oil prices to fund its budget.

“Should there be a failure, then it seems set to be Russia’s fault,” said Paul Horsnell, a commodity analyst at Standard Chartered Plc. “They do not seem to have the understanding of the market and the experience of market stabilization that the key OPEC members have.”

The standoff is the biggest crisis since Saudi Arabia, Russia and more than 20 other nations created the OPEC+ alliance in 2016. Amid collapsing prices, the risks for Friday’s discussions are high, not just for the alliance, but for oil-rich nations and the energy industry as a whole.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS