By Jackie Davalos

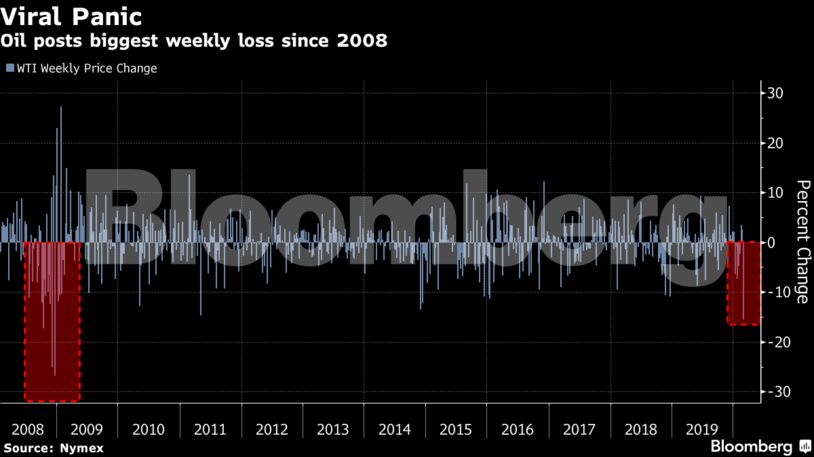

Oil prices have tumbled almost 27% this year on concerns the coronavirus outbreak will dent crude demand. OPEC and its allies have signaled the coalition could reach an agreement to stem the rout before meeting in Vienna next week. Saudi Arabia is reportedly pushing for collective OPEC+ production cuts of an additional 1 million barrels a day, of which it would bear the brunt.

However, Riyadh’s proposal may not be enough to balance the oil market, according to a coronavirus-scenario analysis by Bloomberg Intelligence analysts Salih Yilmaz and Rob Barnett. The alliance’s overall compliance with production cuts has not been enough to support oil prices. The re-emergence of Libyan barrels also remains a risk.

“We may be too far deep for any OPEC cuts to have a meaningful impact,” said Peter McGinn, market strategist at RJ O’Brien & Associates LLC. “If the virus keeps spreading, that is just going to keep hurting demand and cause another wave of panic selling. A production cut could give it a bounce, but these lows will persist for the foreseeable future without a vaccine.”

West Texas Intermediate futures for April delivery fell $2.33, or 5%, to settle at $44.76 a barrel on the New York Mercantile Exchange.

Brent for April settlement, which expired Friday, lost $1.66, or 3.2%, to end the session at $50.52 a barrel on the ICE Futures Europe exchange. The more active May contract fell 4% to $49.67.

Brent’s so-called red spread — the difference between December contracts in consecutive years — sank deeper into bearish contango, settling at lowest level since 2018.

| Oil market drivers |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS