By Liam Denning

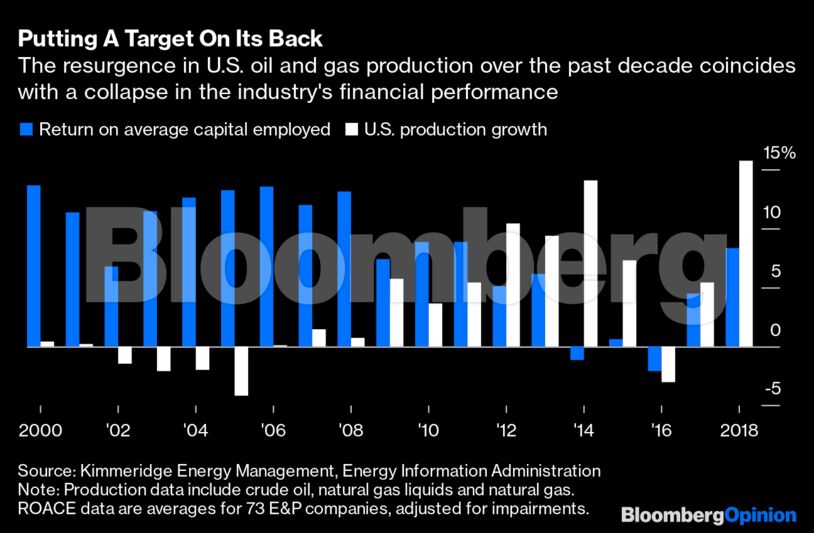

Kimmeridge’s diagnosis is inarguable. The shale decade unleashed an unprecedented torrent of U.S. oil and gas; profits, not so much.

The root of the problem is that mindset of “peak oil” scarcity which took hold in the early 2000s. The resulting high commodity prices fostered the shale boom. But the hunt for ever more barrels — always a natural instinct in this business anyway — reached pathological levels, abetted by easy financing and c-suite incentives emphasizing quantity over quality. Now scarcity has given way to excess, the carnage in energy portfolios is glaring, and E&P has become all but uninvestable.

The key variable here is time.

When conventional wisdom held oil was scarce, barrels under the ground were viewed as an appreciating asset, like wealth in a vault (see this). So even if a company’s land-grab generated red ink and the smell of burning cash today, management could point to the horizon and such metrics as net asset value (essentially a modified discounted cash flow figure). Like any such analysis, NAV is only as good as its underlying assumptions. And if your big assumption is that oil demand and prices ultimately only go up and to the right, then why wouldn’t you invest every spare dollar (and then some) in new holes in the ground?

It’s now abundantly clear that, rather than running out of oil and gas, we’re running out of our capacity to safely absorb the associated emissions. The frackers’ own innovations boosted supply, deflating oil and gas prices. In that sense, the NAV fetish turns out to be its own cure.

What’s needed is a new time horizon, one that’s more here-and-now rather than from-here-to-eternity. Kimmeridge suggests about 10 years; as in, E&P companies commit to pay out the equivalent of their entire valuation over that period. In other words, offer a 10% free cash flow yield. This would shift them away from theoretical, NAV-based value receding ever further down the line to tangible rewards on a more human timescale. This would also address investors’ loss of faith in another sustained oil-price upswing since, after making back their money, they would still own that option.

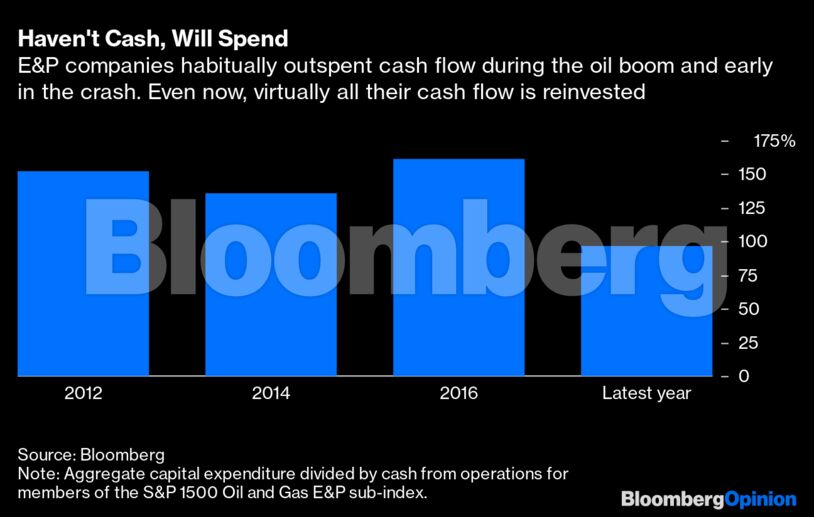

The target would also enforce fiscal discipline — you can’t pay out cash if you spend it all (and bond buyers have walked away). Kimmeridge suggests committing to reinvesting less than 70% of cash from operations (or 80% during better oil-price environments), far lower than the industry’s usual levels.

Cutting spending necessarily means less drilling and less production — which is good. Continuing to spend money when investors, commodity prices and the obscenity of rampant gas flaring are signaling you to slow down begins to look like a disorder. Lower capital expenditure means less cash put into unprofitable projects, more cash put into shareholders’ pockets and, with lower production growth, support for commodity prices.

Overhead also needs cutting. The industry’s fragmentation was a strength as operators competed to innovate and push down costs in shale production. Now it’s more of a millstone, replicating corporate structures and costs across dozens of operators in the same basins. Consolidation would free up cash and, by aggregating landholdings, make it easier to develop promising areas more efficiently and drop the marginal stuff.

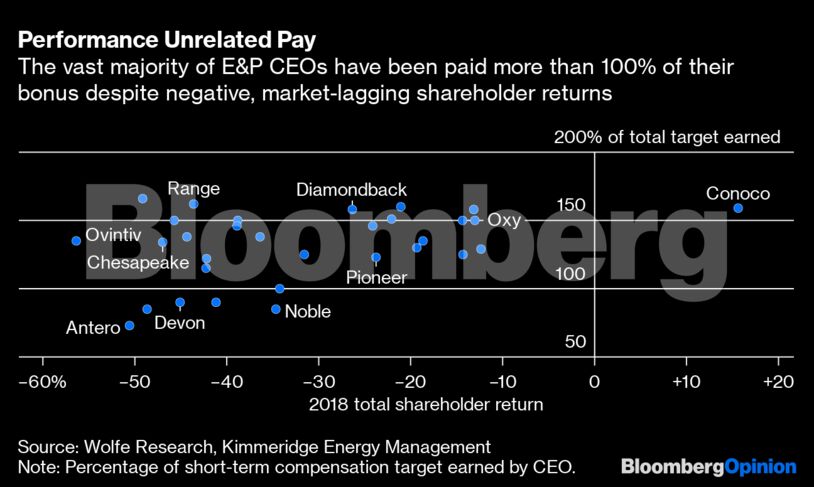

None of this can happen without fixing broken incentives. A big problem is E&P companies grading themselves versus each other rather than the wider market — a recipe for big executive paychecks despite lousy returns when the whole sector is lagging (see this). You can’t get good results if you reward failure. This chart by analysts at Wolfe Research shows the percentage of target bonus payments earned by 31 E&P CEOs versus total shareholder return in 2018. Notice how 25 of them earned at least 100% of their target bonus — and often much more — despite inflicting losses on investors.

Note that only ConocoPhillips appears in that top right quadrant. Conoco adopted Kimmeridge’s playbook ahead of time, committing to payouts across the 2020s equivalent to almost 100% of its current market cap. Conoco recognizes growth and oil-price bets aren’t being rewarded; low costs and line of sight on real rewards are.

Think about this in the context of the recent IPO of the biggest of Big Oil, Saudi Arabian Oil Co. Saudi Aramco’s great strength is its ginormous oil reserves; a NAV model fantasy. Yet, in order to get a valuation acceptable to the Saudi state, Aramco had to promise bond-like dividend payments for several years and, even then, quarantine the IPO in Riyadh. Foreign institutions wouldn’t just take a flyer on the profferred 4.4% dividend yield or, looked at differently, implied 23-year payout schedule.

Time horizons have shortened mostly because of the lessons of the past decade, but also partly because the shadow of climate change looms over the terminal values embedded in oil and gas stocks. Kimmeridge’s brand of activism could help here, too, obliquely.

When BlackRock Inc. CEO Larry Fink recently released his letter on climate risk, I noted he should press E&P companies to fix their c-suite incentives. Like the sector’s broken financial model, unbridled carbon (and methane) emissions represent a mindset of constant deferral. This ultimately manifests as excess, involving production and consumption of fuels without proper consideration of their full costs, be they capital or climate.

Rationalized E&P investment would also ration emissions. And this needn’t involve oil bosses undergoing some Damascene conversion about climate — just a recognition of shifting risks. Whether oil demand does or doesn’t peak within 10 years, those companies returning most of their value on something like that schedule should be stronger either way. When feeling inundated, the best course of action can be to swim with the tide.

— “Performance Unrelated Pay” chart by Elaine He

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS