By Julian Lee

The initial reaction resembles that of an agitated anthill, with frantic scurrying in all directions amid an apparent lack of coordination. The final days of last week saw calls for their next meeting, scheduled for the first week of March, to be brought forward, perhaps by as much as a month. That move appeared to be driven by Saudi Arabia, OPEC’s biggest producer, but initially found little support from the largest of the non-OPEC members of the wider group — Russia.

One of the key challenges facing the Organization of the Petroleum Exporting Countries and its big oil-producing counterparts is that they have no idea how big a problem they face. At this point, estimates of the epidemic’s impact on oil demand vary widely. S&P Global Platts sees global oil demand falling by an “almost catastrophic” 2.6 million barrels a day in February and 2 million barrels in March in its worst-case scenario. No wonder producers are in a panic.

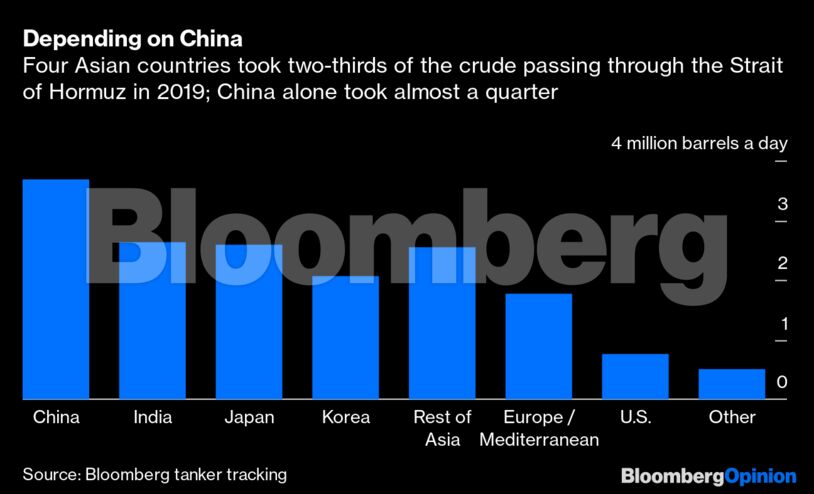

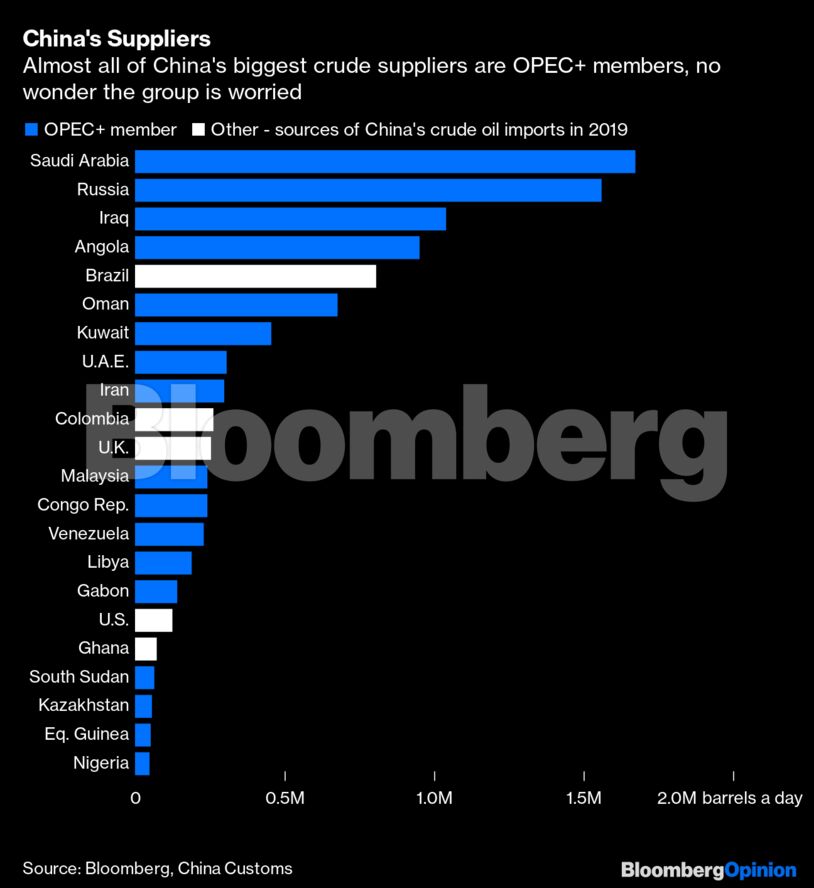

China is, by far, the biggest market for OPEC+ crude exports, with the big Persian Gulf producers particularly vulnerable. Tanker tracking data compiled by Bloomberg show that almost a quarter of all shipments out of the region last year went to China. Add in the other three big Asian buyers — India, Japan and South Korea — and that share rises to two-thirds.

It is difficult to overestimate the importance of China to global oil balances. Earlier this month, OPEC’s own forecasts showed the world’s most populous country accounting for more than a quarter of all the growth in oil demand worldwide this year. The International Energy Agency saw it playing an even bigger role, with almost 40% of incremental demand in China. The word “virus” didn’t appear in either of those agencies’ monthly reports.

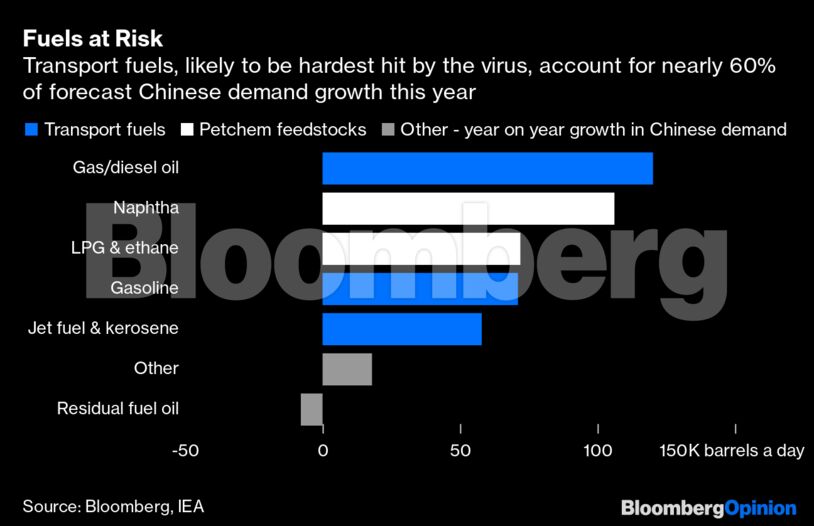

The virus will not affect all oil products equally. With travel bans and an extended Lunar New Year holiday, transport fuels will be hit hardest. Gasoline, jet fuel and gas/diesel oil were expected to account for 55% of China’s oil demand this year and make up almost 60% of the growth.

It is these products that will be hardest hit — and not just in China. Flight bans to China by many airlines, including British Airways Plc and Delta Air Lines Inc., and travel restrictions on Chinese tourists will have a knock-on effect on fuel use elsewhere, particularly in nearby countries that are favored destinations for tour groups.

And then there’s all of the other knock-on effects. Lower demand from end users means lower demand from refiners. Major state-owned Chinese refiners may cut run rates below 70% to cope with falling demand, industry consultant JLC said in a note, while operating rates at privately-owned independent refineries in the eastern Chinese province of Shandong may be cut to below 50%.

Even before the new coronavirus began to hit oil consumption, the swing producers that make up OPEC+ were in trouble. The hard-won output deal they reached in December failed to deliver any significant cuts to total output levels, and prices have drifted lower. The deal’s currently scheduled to expire at the end of March. Simply extending the cuts will do nothing to improve the worsening balances between supply and demand, and therefore it will take more to light a fire under oil prices. Deeper cuts will be much harder to agree — Russia, for one, is against them — but that’s the only thing that will lift prices in the face of a Chinese slowdown.

There are already signs that slowdown is happening. Sales of Latin American oil cargoes to China ground to a halt last week. Persian Gulf producers are starting to receive preliminary nominations from their customers of how much oil they want in March, and that will indicate whether Chinese refiners seek to reduce the volumes they lift from export terminals in the region.

Non-OPEC countries — led by the U.S., Norway, Brazil and new producer Guyana — were already expected to add two extra barrels for every additional one consumed worldwide this year, squeezing OPEC. The loss of much of China’s oil demand growth will crush the producer group under the weight of falling oil prices, unless, collectively, they cut their output further.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire