By Rakteem Katakey and Ann Koh

Investors are struggling to gauge whether the virus will turn into a global pandemic and how severe the economic impact will be. A meeting of the Organization of Petroleum Exporting Countries and its allies next week is taking on even greater significance as the market waits to see if the alliance will agree to deeper and longer production cuts to counter a slump in demand.

“It’s more and more about what this means for demand, and it looks like there’s more weakness to come in the short-term,” said Michael Poulsen, an analyst at Global Risk Management Ltd. “The big question is how wide and deep the impact of the virus is going to be.”

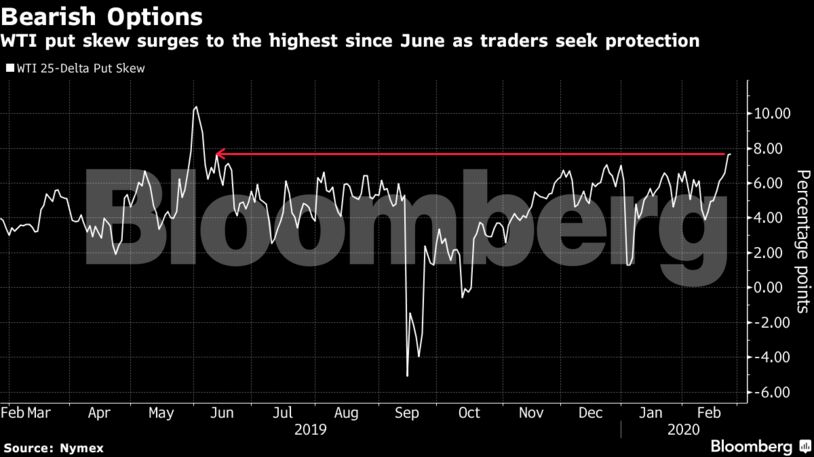

West Texas Intermediate for April delivery fell to $49.21 a barrel on the New York Mercantile Exchange as of 9:34 a.m. in London, after closing down 3% on Tuesday. The so-called put skew — the premium traders will pay for options protecting against a drop in prices over those protecting against a rise — is at the highest level since June.

Brent for April declined 1.6% to $54.06 a barrel on the ICE Futures Europe exchange after dropping 2.4% in the previous session. The global benchmark crude was at a $4.82 premium to WTI for the same month.

While the oil market is also struggling with rising supply. The American Petroleum Institute reported that crude inventories rose by 1.3 million barrels last week, according to people familiar with the data. That would be a fifth straight weekly build if confirmed by official government data later on Wednesday. A Bloomberg survey forecast a 2.6 million barrels rise, according to a Bloomberg survey.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire