By Liam Denning

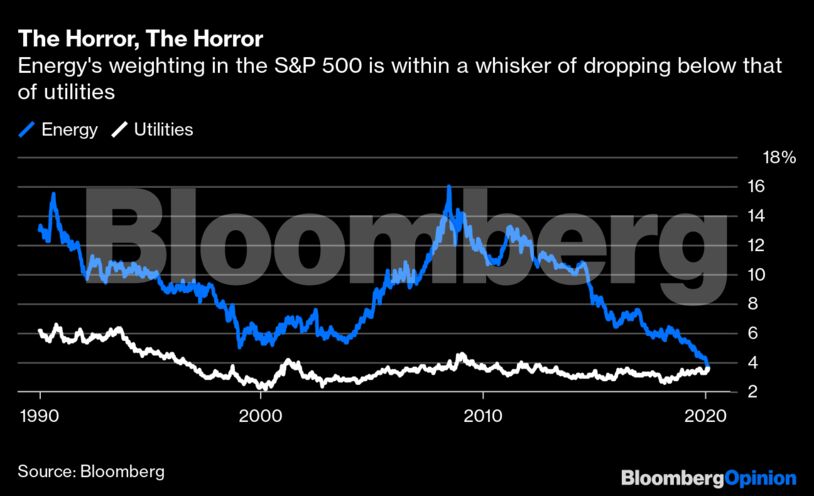

The two sectors closed out a Tuesday to forget with weightings barely 4 basis points apart. All else equal, for energy to shrink below the weighting of utilities, oil and gas stocks need only drop another 1.2% . The sector’s down almost 9% so far this week.

It is tempting to read as little or as much into this as one likes. The spread of coronavirus is a genuine black swan that will tend to hit exposed cyclical sectors (oil and gas) and support traditional havens (utilities). The latter do look stretched, valuation-wise: At almost 21 times, utilities sport the highest forward price/earnings ratio of any major S&P 500 sector, besting even tech by more than a point.

At the other end of the scale, green-tinged schadenfreude can be expected, as energy’s demotion is seen as a portent of a carbon-woke, increasingly electrified society. There is some truth to that, too, as expectations of peak oil demand — which are different from and foreshadow the actual event — mess with the terminal values embedded in energy valuations.

The biggest factor may lie somewhere between the immediacy of relative sector sentiment and the existential challenges of the future. As observed in everything from Exxon Mobil Corp.’s dividend yield (hitting a new high of 6.4%) and the increasingly junky spreads in energy high-yield bonds, coronavirus has hit an industry weakened by its prior excesses. Not a message likely to find favor in Houston either, but then the market’s never been that polite.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso