By Matthew A. Winkler

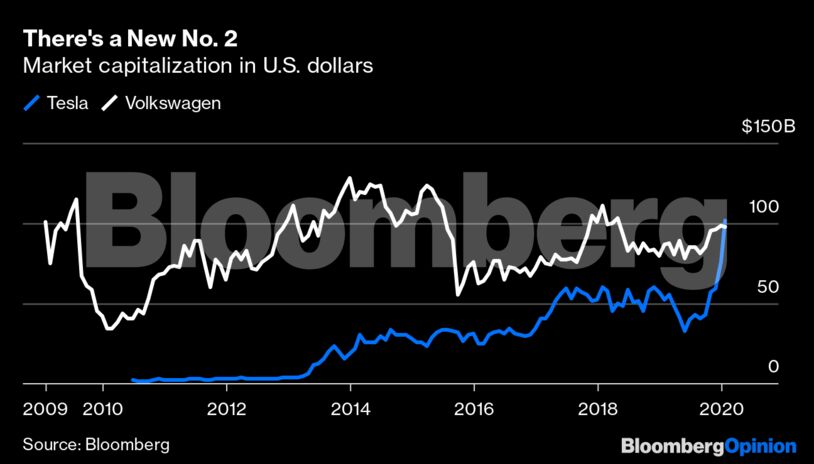

Tesla Inc., the 17-year-old Palo Alto maker of battery-powered, zero-emission vehicles, is now the second-largest automaker measured by market capitalization, overtaking No. 2 Volkswagen with a value of $101 billion. It wasn’t long ago that no industry analyst would have predicted that the 82-year-old Wolfsburg, Germany-based seller of 30 times as many vehicles last year would become an also-ran to Tesla. Most of them remain unconvinced that Tesla is worth its price of $558 a share and less than 32% recommend buying the stock, according to data compiled by Bloomberg.

But Tesla customers and investors are making the case that the reliance on the internal combustion engine by Volkswagen — and by the 39 other major automakers committed to a commercial fossil fuel machine invented in the 19th century — is a dubious strategy. Tesla is worth $131 billion less than No. 1 Toyota Motor Corp., but its sales growth has been more than nine times the industry average during the past decade and 832 times Toyota’s 25% appreciation since Tesla became a public company in June 2010 with an initial valuation of $2 billion. It opened its largest service center in Germany last year and agreed in December to build its first European car factory, in the state of Brandenburg.

All of which explains why Tesla has been poised to catch Volkswagen in the stock market since 2014. That’s when U.S. regulators confirmed that Volkswagen equipped more than 10 million vehicles worldwide with software to defeat emissions tests, an existential moment for the industry. The global sales leader in effect revealed that growth depended on making cleaner vehicles, and that it would cheat if necessary to stay ahead.

Volkswagen subsequently admitted that it had conspired to violate the U.S. Clean Air Act and paid a $4.3 billion fine. Several senior executives were sentenced to prison and former Volkswagen Chief Executive Officer Martin Winterkorn and six other Volkswagen executives were eventually criminally charged by German prosecutors.

Volkswagen still is beloved by industry analysts, 86% of whom favor the German automaker with a “buy” recommendation, according to data compiled by Bloomberg. Volkswagen now wants to emulate Tesla and recently raised its battery electric production target to 1.5 million vehicles in 2025. Tesla sold a record 367,500 vehicles in 2019.

“The time of the traditional car manufacturers is over,” said CEO Herbert Diess in prepared remarks at an internal Volkswagen meeting this month. “The magnitude of our task and the brevity of time” necessitated by Tesla’s challenge “gives us exactly one single try,” he said.

Diess, who was a member of the management board at Bayerische Motoren Werke AG before he joined Volkswagen as chairman and CEO in 2015, should know. As recently as 2013, Volkswagen’s $109 billion valuation was seven times more than Tesla’s. By 2015, the gap had narrowed to $22 billion and was just $10 billion after the first week of January. During this period, the average 5-year and 3-year returns (income plus appreciation) for the 10 largest automakers were 30% and 28%, respectively. Volkswagen investors suffered by comparison with a loss of 4% and a gain of 20%. Tesla shareholders crushed the industry, earning 181% and 120%, according to data compiled by Bloomberg.

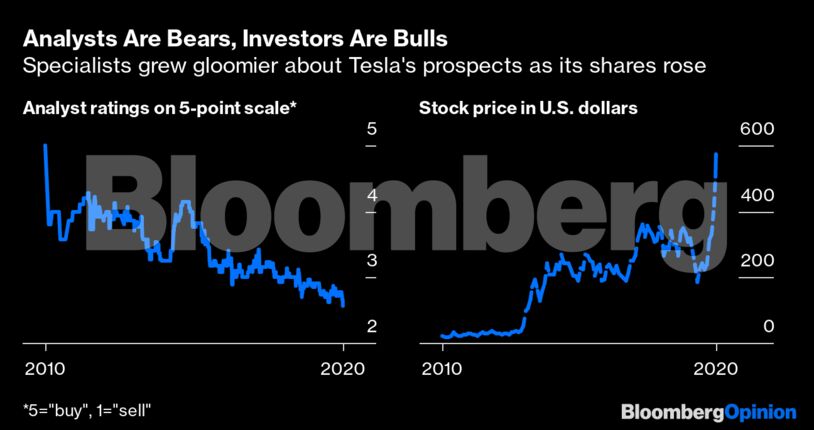

Yet too few analysts agree with Diess’s assessment. The Bloomberg Recommendation Consensus shows that the appraisal of Tesla by 36 analysts, measured on a scale of 1 to 5 (the most bullish), has fallen 37% from 4.1 in 2015 to 2.57 when the comparable measure for the Russell 3000 is 4.05. Bloomberg ranks the performance of analysts by calculating the total return of their buy and sell recommendations. The top 10 analysts have a target price for Tesla of $454 a share. The bottom 10 have a target of $397 a share.

Ryan Brinkman, the automotive equity research analyst for JPMorgan Chase Bank, is among the biggest Tesla bears, with a target price of $240 a share and a sell rating for the next 12 months. He has issued 28 consecutive sell recommendations since February 2015; Tesla has appreciated 178% since then. During the preceding three years, he initiated 14 “neutral” or hold ratings in a row as the shares were climbing 487%, according to data compiled by Bloomberg.

Colin Rusch, a top-10 performer in the group and the Oppenheimer & Co. analyst who is most bullish on Tesla, said on Jan. 13 that the shares were worth $612, a 59% increase from his $385 target price published Jan. 3. He said the company was a buy on Aug. 2, 2018 and rated the shares a buy even when they lost almost 50% between August 2018 and June 2019. Tesla shareholders who followed Rusch’s buy and sell suggestions throughout the past 12 months made 90%, according to data compiled by Bloomberg.

Investors who followed his advice on the 26 stocks he covers reaped a total return of 41% as against the 16% return that would have gone to followers of his top 10 peer group. More than half of Rusch’s companies are committed to clean energy rather than being traditional auto stocks.

As for Tesla, Rusch is the lonely analyst who agrees with Volkswagen’s Diess. “While Tesla has stumbled through growing pains, we believe the company has reached critical scale sufficient to support sustainable positive free cash flow,” Rusch wrote earlier this month.

That’s another way of saying that the best for Tesla is yet to come.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso