By Liam Denning

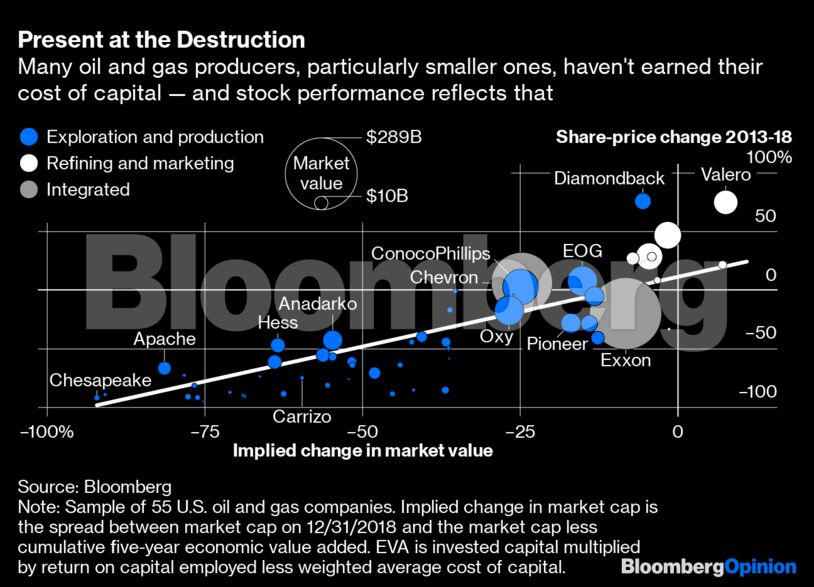

More pertinent is that bigger companies — especially refiners — tended to fare better than the cloud of smaller bubbles trailing off to the bottom left of that chart. This gets at a critical issue regarding what comes next for the sector.

The past decade’s boom in U.S. oil and gas production owed much to a crowd of relatively small companies competing with each other and backed by enthusiastic capital markets. But as oil has settled into a lower, more volatile range (and gas has fallen into a coma), so the advantages of being bigger have become apparent. Smaller exploration and production companies, in particular, tend to have higher unit costs and lower valuation multiples (i.e., a higher cost of capital; see this).

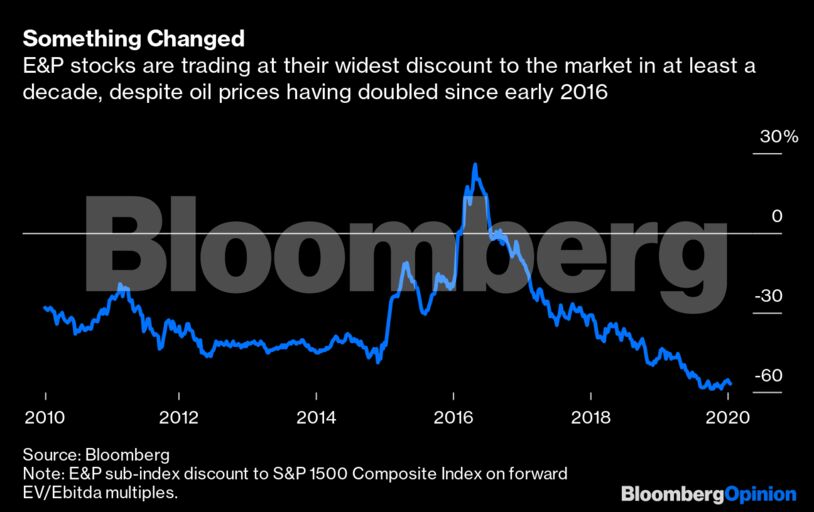

The sector has been structurally devalued versus the wider stock market. Moreover, while average yields on energy junk bonds have come in from December’s peak of almost 10%, they remain above 8%, markedly higher than the 5-7% range that held through much of the past decade.

Higher risk premiums mean a higher hurdle to beat than the one the sector largely missed already over the past five years or so. Notwithstanding President Donald Trump’s efforts to reduce regulatory costs, climate concerns are likely to widen those risk premiums further over time.

That was the message in BlackRock Inc. CEO Larry Fink’s latest missive on the subject. As I wrote here, even if most of the money BlackRock manages is passive, it can still use that to vote for change in the governance standards prevalent in the sector that have prioritized growth above all and protected incumbent management teams. And based on data compiled by Bloomberg, BlackRock holds roughly $25 billion worth across more than 100 U.S. E&P firms, adding up to an average stake of 7% (albeit ranging from virtually zero for some stocks all the way up to 15%).

With capital costlier than it used to be, the imperative for smaller companies in particular to consolidate and jettison the cost burden that comes with maintaining separate identities (and management and campuses and accounting and …) is getting ever stronger. Two decades ago, the supermajors were created in response to a structural change in the investment landscape for oil and gas. We are at that point again, only at the opposite end of the scale.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS