By Sharon Cho and Grant Smith

The clash is fanning fears that a wider conflict could disrupt supply from the region, which provides almost a third of the world’s oil. Prices haven’t hit these levels since an attack on Saudi Arabia’s oil facilities in September — which the U.S. blamed on Iran — briefly halted about 5% of global output.

“Crude has some more risk pricing to do,” said Bob McNally, president of Rapidan Energy Group in Bethesda, Maryland, and former White House oil official under President George W. Bush. “We are going to grind through the $70s up toward $80 Brent as Iran calibrates and executes its retaliation.”

Trump said he’s prepared to strike “in a disproportionate manner” and more than 50 Iranian sites could be hit if Tehran retaliates against the killing of General Qassem Soleimani. The Middle East nation said it has to “settle a score with the U.S.” and that it would no longer abide by limits on its enrichment of uranium. A vote by Iraq’s parliament to expel U.S. troops from the country deepened the strain in the region.

Brent futures rose to as high as $70.74 a barrel on ICE Futures Europe and were 1.1% higher at $69.37 as of 1:26 p.m. in London. The contract surged 3.6% on Friday. West Texas Intermediate for February advanced 1% to $63.66 on the New York Mercantile Exchange.

The political tension is buffeting a market that had already been tightening, in large part because of production cuts by OPEC and its allies. The premium for immediate Brent futures compared with those seven months ahead more than doubled in the fourth quarter.

The U.S. warned of a risk of attacks in Saudi Arabia, particularly in the eastern province and near the Yemeni border close to military bases as well as oil and gas facilities. Trump is also sending more troops to the Middle East.

Saudi Arabia, Iran and Iraq together pumped more than 16 million barrels of oil a day last month. Most of their exports leave the Persian Gulf through the Strait of Hormuz, a narrow waterway that Iran has repeatedly threatened to shut down if there’s a war.

Rising tensions between the U.S and Iran have already caused considerable turbulence in oil markets, but so far it’s been short-lived. Last year, Washington blamed Tehran for sabotage attacks on supertankers and a missile and drone attack on Saudi Arabia’s Abqaiq crude-processing plant in September — the largest single supply halt in the industry’s history. Iran denied involvement.

There are also other signs in the oil market that people were preparing for further disruption.

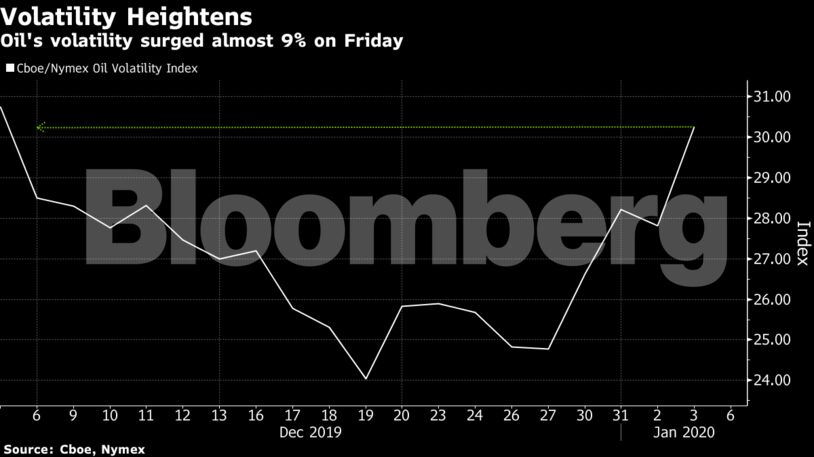

Volatility has risen to the highest level in a month and the cost of derivatives that insure against price spikes increased. Four million barrels of options contracts that would profit from a jump in Brent crude to $95 a barrel traded for both March and September. The cost of insuring tankers could rise again, after it surged in the wake of the Abqaiq attack in September.

Still, after climbing 23% last year oil prices may have already reached levels that don’t leave much scope for further gains. Goldman Sachs Group Inc. said an actual disruption to global supplies is needed to keep prices at current levels.

“The oil market always assumes the worst, so a lot of the general risk is already priced in,” said Jaafar Altaie, managing director of Abu Dhabi-based consultant Manaar Group. “Prices at $70 a barrel already assume the worst-case scenario and we see them holding there.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS