By Bloomberg News

Tesla, which is already churning out more than 1,000 Model 3 sedans a week at its plant on the outskirts of Shanghai, handed over a batch of cars to a select group of employees on Dec. 30, but Tuesday marks the first deliveries to the general public. The ceremony is due to start at 3 p.m. local time at Tesla’s first factory outside the U.S., a milestone in Musk’s plans for the company he founded to go global.

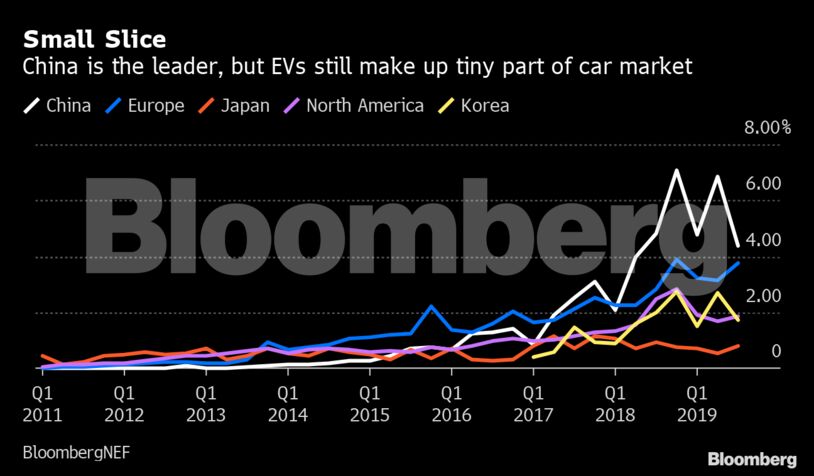

Yet it comes at a challenging time in China’s auto market, where forecasts point to a third-straight annual drop in total sales. Electric vehicle sales plunged 42% in November from a year earlier as the government pared back subsidies on purchases. In a bid to lure buyers, Tesla cut the starting price of its China-build Model 3 sedans by 9% so that they’ll be more closely aligned to some local EV makers. It may cut prices further mid-year as it increases localization of components, people familiar with the matter have said.

“The demand for our locally-built model 3 is very good,” Allan Wang, general manager of Tesla China, said last week. “We are confident about selling all vehicles manufactured in this factory.”

Tesla didn’t immediately respond to a request for comment.

After capturing about 5% of China’s car sales, the slowdown for electric vehicles could spell trouble for a launch that investors are watching closely for evidence that Tesla has what it takes to go global. A slow start for sales of its made-in-China cars would put more pressure on the unprofitable manufacturer’s finances, giving Musk little room for missteps to support a stock that’s hovering at an all-time high.

“Tesla is rushing to start deliveries before other global brands bring in more EVs,” said Zhang Yan, an analyst at research firm LMC Automotive in Shanghai. “It’s an attempt to conquer the market.”

Musk and his team are looking at a market that’s very different from mid-2018, when the decision to build a Shanghai plant was announced. Back then, the industry’s sales were growing at a roughly 100% clip.

The tough market could mean that Tesla sells just 21,000 China-built Model 3s this year, according to LMC Automotive. That would qualify as a sluggish start given the Shanghai facility already builds more than 1,000 cars a week and plans to double production during the next year.

Musk’s China Optimism Tested as Tesla Starts Local Deliveries

The forecast takes into account Tesla’s history of production delays, potential supply-chain constraints and the complexity of manufacturing high-quality cars at scale, LMC Automotive said.

Yet others are more optimistic. Yale Zhang, managing director of Shanghai-based consultancy AutoForesight, said Tesla could sell about 100,000 Model 3 cars. Wang Lei, a Shanghai-based analyst for China International Capital Corp., said Tesla could sell a combined 120,000 Model 3 and Model Y vehicles.

Given Tesla’s volatile share price, investors will be hyperfocused on the Shanghai ramp-up.

Success in boosting China sales could propel Tesla to as high as $500 a share, a Morgan Stanley analyst, Adam Jonas, said in a December note to clients. Tesla climbed to a record $443.01 on Friday after rising 26% last year. Analysts expect the stock to fetch $311.41 in 12 months, based on 31 target prices compiled by Bloomberg.

So far, the China project has gone smoothly. Musk’s visits helped the company get preferential bank loans and swift approvals for construction and manufacturing. And while the subsidies are being phased out, the locally built Model 3 still qualified for a sizable handout of as much as about $3,550 per car.

But success requires winning over the consumer. A majority of China’s EV purchases — about 70%, according to Sanford C. Bernstein — so far have been to the government and “policy-direct” customers, including taxis, mobility services and other government-affiliated fleet operators. Such buyers typically forgo premium cars like Teslas in favor of cheaper, local models.

“It’s a distorted need,” said Robin Zhu, an analyst with Bernstein. “And the market won’t change much in the next two-to-three years.”

Cars that cost less than 100,000 yuan ($14,300) make up more than half of EV sales in China, according to Bernstein.

“To paraphrase Elon Musk, demand may be insanely high, but people literally cannot afford to buy them,” Zhu said.

To be sure, there is a segment of China’s massive population that can afford Teslas. But the Palo Alto, California-based company won’t be the sole global EV brand targeting those buyers.

Volkswagen AG’s Audi plans to start selling nine new-energy-vehicle models in China during the next two years, with more than half of them being pure battery-electric. The first electric model, the E-Tron, debuted in November at a starting price of about 693,000 yuan.

Daimler AG’s Mercedes-Benz EQC electric model became available in October and starts at 580,000 yuan. BMW AG plans to start building the iX3 crossover in China next year and is working with a Chinese partner to electrify its Mini model.

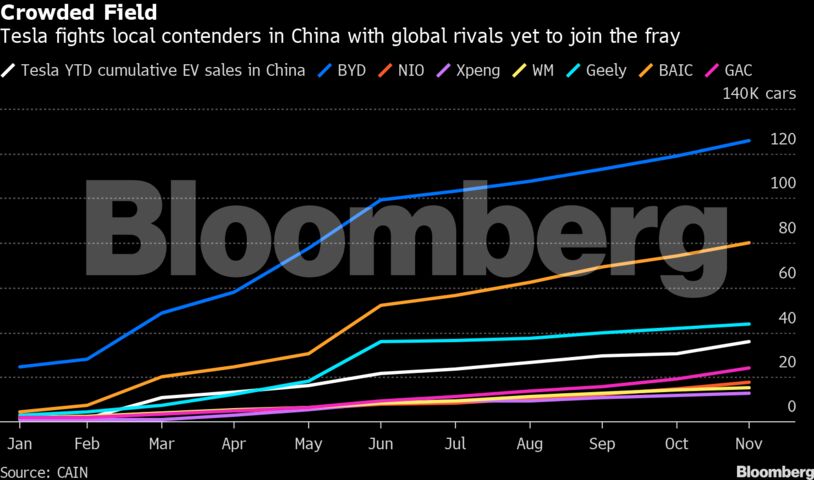

There also is a slew of local upstarts targeting the premium segment. Electric SUVs from NIO Inc. and Guangzhou Xiaopeng Motors Technology Co., or Xpeng Motors, are priced aggressively and already have found fans.

“It will be challenging for carmakers to differentiate themselves and be competitive,” said Stephen Dyer, managing director at Alixpartners, a global consulting firm.

Tesla, a pioneer in electric cars, probably will have an edge for the next one-to-two years before competition starts catching up, said David Whiston, an analyst at Morningstar Inc. in Chicago. Tesla’s vehicles have an industry-leading driving range to go along with the brand appeal.

Boding well for the company, registrations of Tesla vehicles in China rose 14-fold to 5,597 in November. While growing from a low base, the figure suggests healthy demand for its cars even though all the models available thus far have been the pricier imported versions of the Model 3, and the higher-end Model S sedan and Model X SUV.

Tesla also doesn’t have to worry about selling traditional internal-combustion vehicles. Its global rivals operate expensive gas-guzzler plants in China and need to make sure their new EVs aren’t cannibalizing more profitable gasoline-powered lineups.

“Other multinationals, carrying the legacy of traditional automakers, came into the market reluctantly and lately. They are jumping in the pool they never wanted to swim in,“ said Bill Russo, chief executive officer of consulting firm Automobility Ltd. in Shanghai. “Tesla is not a conflicted company. They don’t have to choose.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire