By Ann Koh and Grant Smith

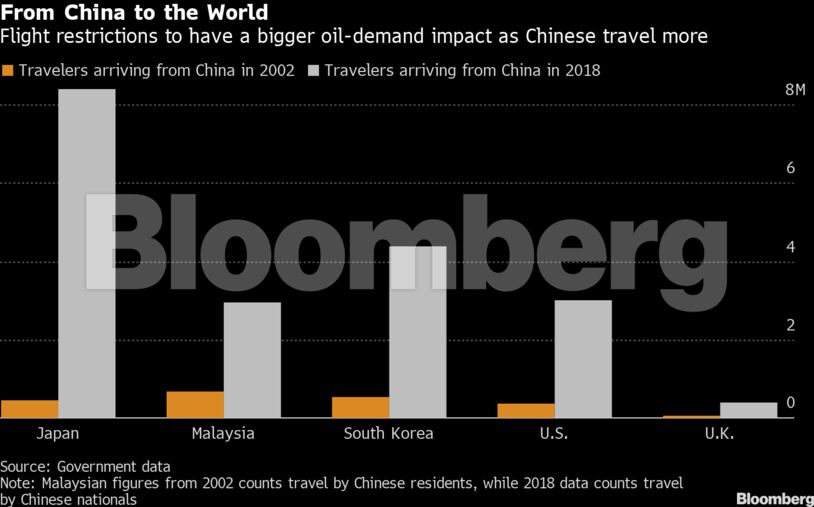

Oil is heading for the biggest monthly drop since May. Authorities in China, the world’s biggest energy consumer, are locking down cities that’s affecting economic and consumer activities. Analysts, including from Sanford C. Bernstein & Co. and Morgan Stanley, are cutting forecasts for the country’s oil consumption, with jet fuel demand most affected.

See also: China Oil Demand Seen Taking a Big Virus Hit in Latest Forecasts

“Oil prices may struggle to find sustained support until the situation is more stable,” said Martijn Rats, global oil strategist at Morgan Stanley.

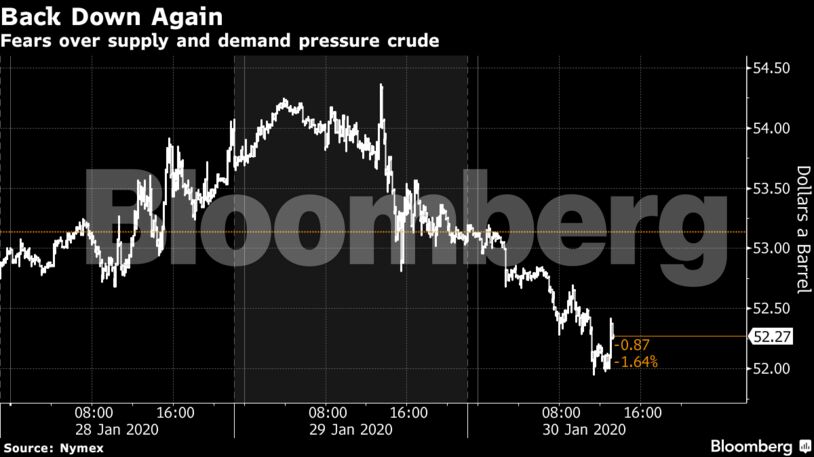

West Texas Intermediate crude for March delivery fell $1.02 to $52.31 a barrel on the New York Mercantile Exchange as of 8:42 a.m. local time. Brent for the same month declined $1.22 to $58.59 on the London-based ICE Futures Europe exchange after rising 0.5% in the previous session.

Crude spiked briefly on Wednesday after an attempted attack on Saudi Aramco’s Jazan plant by Yemen’s Houthi rebels, but the rally soon faded. WTI is down 14% this month.

“Houthi drone launches into the Jazan region are a dime a dozen, and the refinery located in the region is not of critical importance,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS