By Joe Carroll and Kevin Crowley

Blackstone Group Inc., Apollo Global Management Inc., Global Infrastructure Partners and KKR & Co. were all said to be interested in bidding for Western as recently as late 2019.

But it’s been a challenging environment for pipeline companies. In November, Western Chied Executive Officer Michael Ure said the company was seeking new customers in the Rockies and the western edge of the Permian Basin to reduce reliance on Occidental. Western fell 29% last year — its worst performance since 2015 — amid a slowdown in drilling and plunging prices for natural gas byproducts.

Market Reacts

Occidental shares surged more than 4% to vie with EOG Resources Inc. for the top spot in the S&P 500’s Energy Index. Western units rose 3.6% at 2:20 p.m. in New York trading.

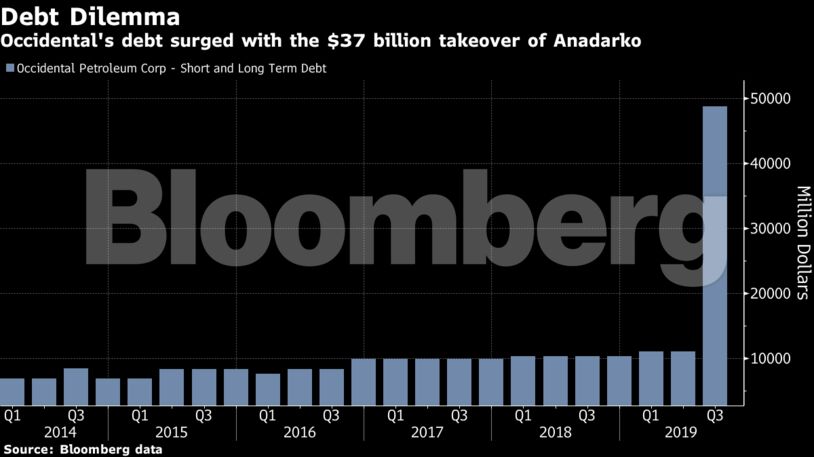

Western’s management team will transfer out of Occidental to ensure “independent managerial control,” the pipeline company said. Occidental said the move is part of a broader initiative to “maximize shareholder value” following last year’s at-times bruising Anadarko transaction.

What Bloomberg Intelligence Says

“Western Midstream’s future is uncertain, as options for new sponsor Occidental include a full disposal of the 56% stake in Western that it inherited. Western is undertaking its largest growth plan as it seeks new third-party volume, though spending is set for a 20-30% drop this year.”

— Michael Kay, BI analyst

Click here for the full report.

The arrangement expands Western unitholders’ rights to replace Occidental as the pipeline operator’s general partner. Western is structured as a master limited partnership, which allows the company to avoid corporate taxes but typically comes with fewer rights for common investors.

Separately, Occidental increased the amount of 2020 hedged production by about 50,000 barrels, or 16%. The recent spike in crude due to tensions in the Middle East provided an opportunity for U.S. drillers to hedge more production.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein