By Liam Denning

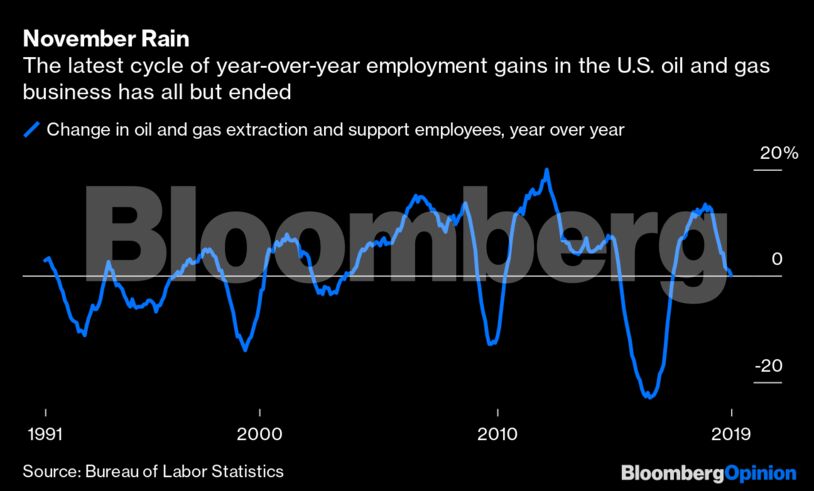

At 30 months, this latest period of gains was notably short, roughly half the length of the two prior cycles. It also came off the deepest jobs recession in the industry going back at least three decades. That whipsaw speaks to both the scale of the crash in energy markets that kicked off in late 2014 and the compressed time scales of shale production versus the longer cycles of conventional fields.

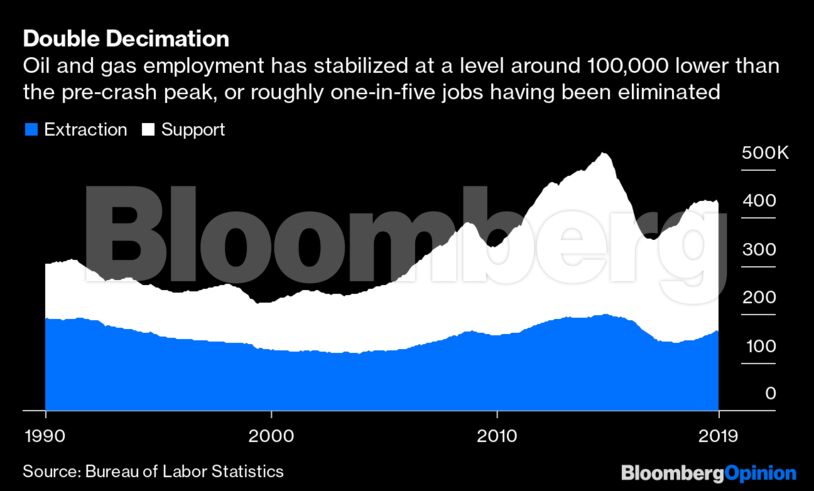

It isn’t all bad, though. While jobs have plateaued, they have leveled out at where they were in late 2015. That is still 100,000 or so fewer than the pre-crash peak. But as is by now painfully clear from the drubbing meted out to E&P stocks, that frenzy of activity was economically unsustainable.

Just this week, Apache Corp. announced hundreds of job cuts despite having also delivered news of a major discovery in offshore Suriname. Meanwhile, Occidental Petroleum Corp. is also beginning layoffs as it tries to reduce the debt taken on in last year’s acquisition of Anadarko Petroleum Corp.

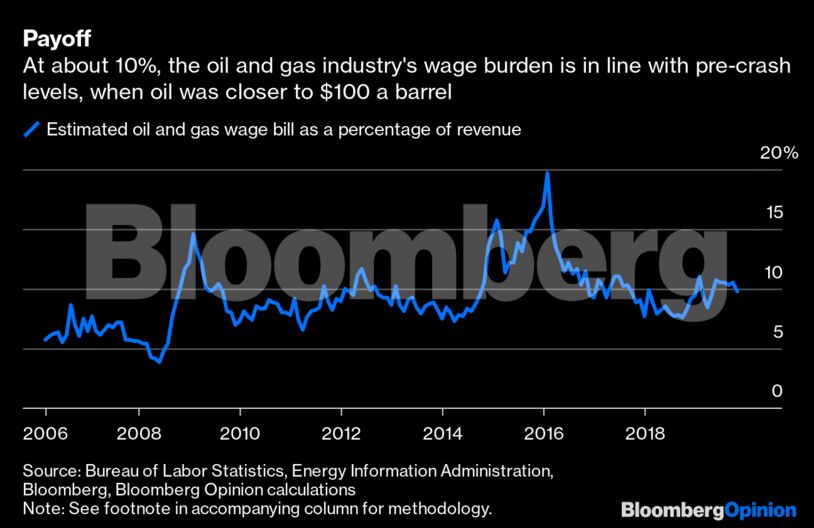

Clouds over long-term demand and the sheer volatility induced by things like tremors in the Middle East mean the mindset of doing more with less should be a lasting legacy of the past five years’ experience. By my rough calculation, E&P wages are running at around 10% of revenue — on a par with 2012, when oil averaged almost $100 a barrel. With E&P companies still early in the process of repairing balance sheets and reputations with investors, even geopolitical frisson isn’t likely to spur another hiring binge.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire