By Michael Bellusci and Divya Balji

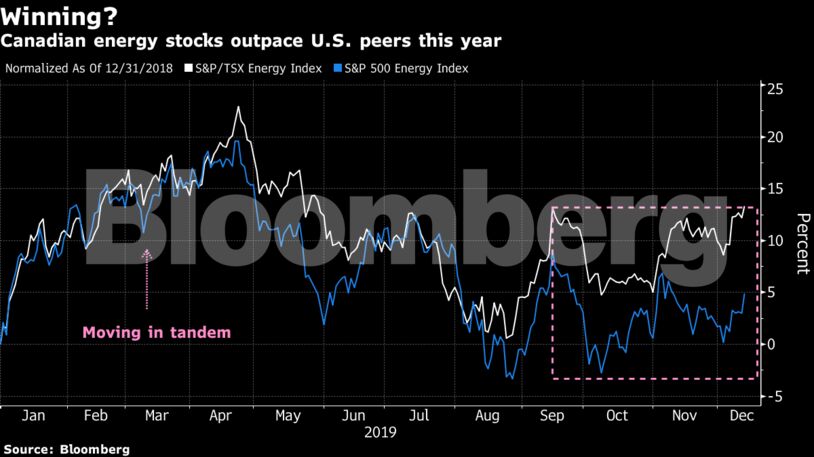

As a result, at least one Wall Street bank has been vindicated in its call for oil-sands companies to outperform shale. Bank of America said earlier this year that shorter cycle projects have attracted investment in recent years, making U.S. shale a “victim of its own success” as production growth has continued while in Canada it’s moderated.

Meanwhile, Canaccord Genuity added Canadian Pipelines to one of its 2020 “contrarian investment themes.” The firm thinks that a lack of transportation options should allow pipeline operators to maintain pricing power. In a note to clients, strategist Martin Roberge also cited the pipelines’ defensive characteristics.

U.S. political risks and shale production concerns are additional reasons for a potential shift of funds back into Canadian energy stocks, according to Toronto-based investment bank Eight Capital. These trends are “helping to create a shift in tide which should put Canadian oil sands/heavy oil in favor over U.S. E&Ps,” the firm said.

Additional catalysts may come from the continued construction of the Trans Mountain pipeline and a decision on Enbridge’s Line 3 project. Enbridge recently said it needs to see “further clarity” on the regulatory and permitting process before making an assessment of when the U.S. segment can come online.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS