By Elizabeth Low and Grant Smith

While leaving most of the tariffs built up over the trade war in place, the partial deal has relieved investors worried about further escalation and driven gains across the commodity complex. It follows deeper-than-expected output cuts agreed by OPEC+ earlier in the month, which Citigroup Inc. said will help keep a floor under prices and which allayed some of the concern that next year will see a renewed oversupply.

“The conditions for a rising oil price appear favorable at present,” said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt. “Economic optimism coupled with a weaker U.S. dollar and growing investor demand have allowed Brent and WTI to climb.”

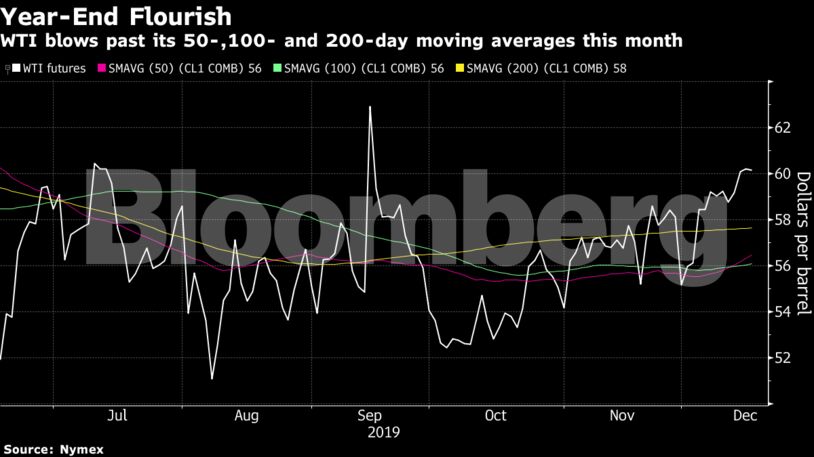

West Texas Intermediate for January delivery rose 30 cents to $60.51 a barrel on the New York Mercantile Exchange as of 8:35 a.m. local time. It advanced 0.2% on Monday and is up around 10% so far in December.

Brent for February settlement climbed 28 cents to $65.62 a barrel on the London-based ICE Futures Europe Exchange, after adding 0.2% on Monday. The global benchmark crude traded at a $5.24-a-barrel premium to WTI for the same month.

If the Bloomberg survey is confirmed by Energy Information Administration data due Wednesday, it would be only the third weekly decline in inventories this quarter and would help to reduce concern over ample supply. However, the EIA said Monday that it expected American shale production to rise by 30,000 barrels a day to around 9.14 million in January.

| Other oil-market |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS