By Alex Longley

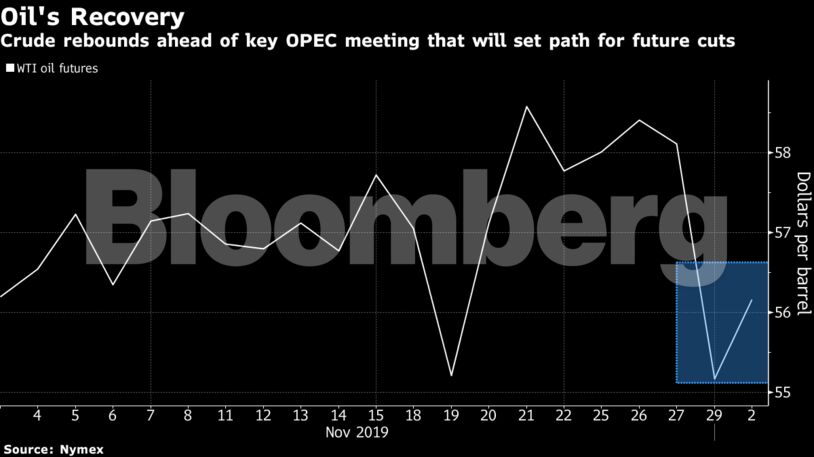

Futures surged as much as 2.7% in New York after plunging 5.1% on Friday. Iraq said OPEC and its allies will consider further output curbs at their meeting this week, forcing traders to weigh the country’s status as the cartel’s second-largest producer against its poor record of actually implementing cuts. An unexpected jump in a gauge of China’s manufacturing sector in November also lifted prices.

The Organization of Petroleum Exporting Countries and its allies have indicated that their meeting in Vienna this week wouldn’t deliver deeper production cuts to prevent the possible return of a surplus next year. Instead, the group is expected to focus on improving the implementation of existing curbs by nations including Iraq, which have consistently flouted their targets. Saudi Arabia has been signaling that it’s no longer willing to compensate for the laggards.

Iraq’s Oil Minister Thamir Ghadhban went against those expectations on Sunday, telling reporters that there could be an additional cut of about 400,000 barrels a day. The Middle Eastern country makes an improbable candidate to push for steeper supply reductions, having actually increased production since last year’s deal and breaking subsequent promises that it would fall into line.

“We consider additional cuts unlikely but a rollover of the current agreement until September or December 2020, with an additional focus on compliance,” analysts at consultant JBC Energy wrote in a report. “Anything on top of that would send a bullish signal, while an extension of only three additional months until June could seem bearish.”

West Texas Intermediate for January delivery rose $1.31 to $56.48 a barrel on the New York Mercantile Exchange as of 12:26 p.m. London time. Brent for February settlement advanced $1.40 to $61.89 a barrel on London’s ICE Futures Europe Exchange. The global benchmark crude traded at a $5.44 premium to WTI for the same month.

Even if the OPEC+ doesn’t need to go beyond its existing curbs, data suggest it will at least need to prolong the supply deal past its current end-March expiry.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso