By Sheela Tobben

Futures edged higher in New York on Tuesday to the highest settlement in almost a week. Members of the Organization of Petroleum Exporting Countries are sending conflicting signals about whether tougher supply caps are imminent as the cartel and its allies prepare for key meetings later this week. Iraq’s oil minister reiterated his view that the group should make deeper cuts.

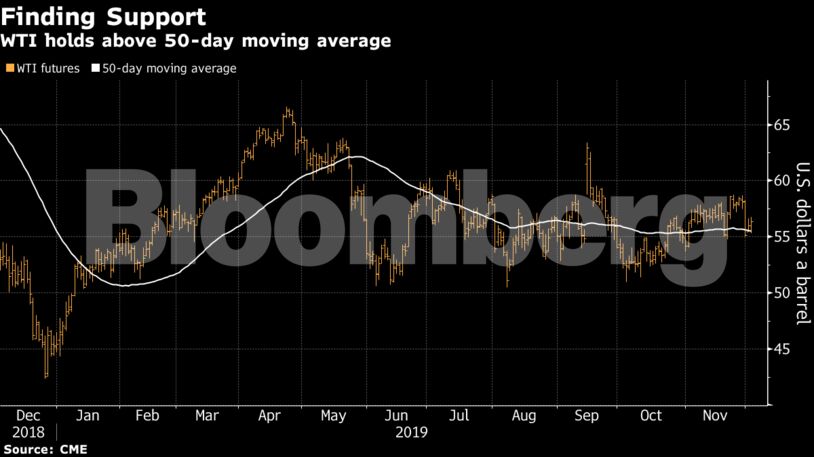

Crude also bounced above its 50-day moving average and the U.S. greenback declined, bullish indicators for chart-watching technical traders.

“With the OPEC meetings coming up, there are expectations that not only will there be an extension of the existing cuts but also a further production cut,” said Andy Lipow, president of Lipow Oil Associates LLC in Houston.

During preparatory discussions on Tuesday, cartel delegates said deepening or extending supply cuts hadn’t been discussed. Earlier in the day’s trading session, futures fell after U.S. President Donald Trump said he was willing to wait another year to sign a trade deal with China.

Iraq’s oil minister Thamir Ghadhban said in Vienna that an additional cut of about 400,000 barrels a day may be needed to offset slowing demand. The American Petroleum Institute reported a 3.72 million-barrel decline in U.S. crude inventories, according to people familiar with the matter, more than double what analysts were predicting.

West Texas Intermediate for January delivery were up 42 cents at $56.36 a barrel on the New York Mercantile Exchange at 4:40 p.m. local time. The contract settled at $56.10.

Read our OPEC+ Reality Check: Deal Extension Likely, Compliance in Focus

Brent for February rose 14 cents to $61.06 on the London-based ICE Futures Europe Exchange, after settling at $60.82. The global benchmark crude traded at a $4.78 premium to WTI for the same month.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS