By Kriti Gupta

As gas output from shale basins climbs to fresh highs, the market needs a polar blast to help siphon off the excess supply. Though exports have soared to a record and American homes and businesses are using more of the fuel than ever, production is outstripping demand, leaving gas stored in depleted aquifers and salt caverns near a two-year high.

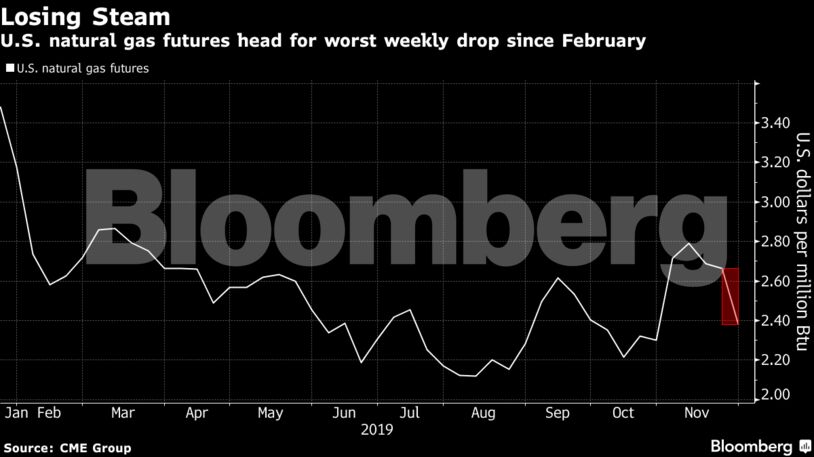

“The weather outlook continues to fall apart for December,” says John Kilduff, founding partner at Again Capital. “Futures broke some key support at the $2.50 level,” and they may now be heading for $2.20, he said.

Gas for January delivery fell 22 cents, or 8.8%, to $2.281 per million British thermal units on the New York Mercantile Exchange. Prices were down more than 13% in November, and the drop on Friday was the worst one-day slide since January. There was no settlement Thursday due to the U.S. Thanksgiving holiday and all transactions were booked Friday.

U.S. gas production rose to 1.5% in August to 112.879 billion cubic feet per day from a month earlier, according to a U.S. Energy Information Administration report Friday.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran