“The OPEC accord with Russia could be fraying a bit,” said John Kilduff, a partner at Again Capital. “It undercuts and undermines everyone’s perception of the commitment.”

OPEC and allies including Russia are expected to extend the current supply pact, rather than make deeper reductions, when they meet in Vienna late next week, a Bloomberg survey showed.

That comes as government data showed the U.S. was a net exporter of crude and refined products for a full month for the first time in at least seven decades. The milestone, which was only previously reached on a weekly basis, underscored the growing influence of American crude in foreign markets, a point that won’t be lost on OPEC.

Despite Friday’s slump, New York-traded futures were on track for the biggest monthly advance since June amid optimism the the U.S. and China are closing in on a trade accord. As for OPEC, a special committee that analyzes market data before ministerial meetings didn’t consider steeper cuts, according to delegates who asked not to be named.

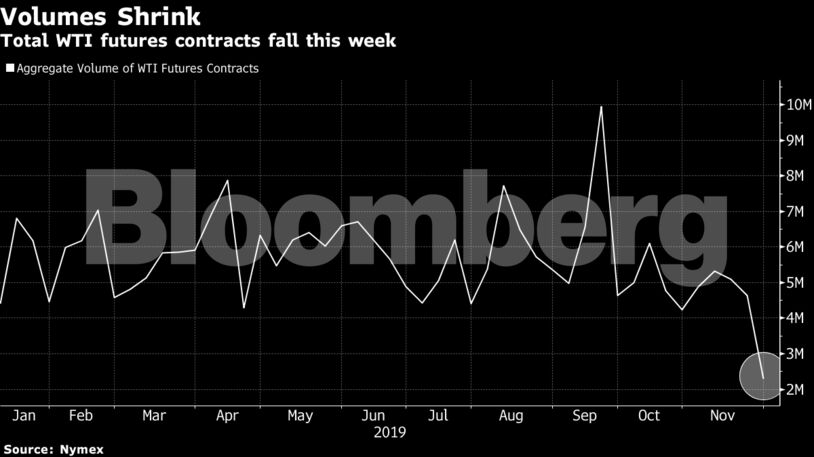

West Texas Intermediate for January delivery slipped $2.94 to settle at $55.17 a barrel p.m. on the New York Mercantile Exchange. There was no settlement Thursday due to the U.S. holiday and all transactions will be booked Friday.

Brent for January settlement, which expires Friday, dropped $1.44 to $62.43 on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a $7.26 premium to WTI.

See also: Ships Stuck Waiting for Fuel at Asian Hub on Rule-Shift Scramble

Saudi Arabia has largely turned a blind eye to cheaters within the OPEC+ alliance, making additional reductions to its own output to offset excesses by the likes of Iraq and Russia. Ministers from the Organization of Petroleum Exporting Countries and its partners will meet in Vienna on Dec. 5 to 6 to decide on policy going forward.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS