“It seems like a pretty interesting opportunity, and that companies should be at least evaluating and thinking about if it could be right for them,” said Tyler Rosenlicht, a portfolio manager for Cohen & Steers Capital Management.

Pipeline companies have traditionally counted on the master limited partnership model, which was once seen as a smart way to raise fresh capital while appealing to retail investors. MLPs don’t pay corporate taxes; instead they pass their cash to stockholders who pay tax on the quarterly payouts.

But MLPs began to lose their allure after the slump in oil prices that began in 2014 triggered cuts to cash distributions. The exodus of investors accelerated in 2018 after a series of changes in U.S. tax policy. As MLP stock prices plunged, some pipeline companies decided to ditch the structure altogether.

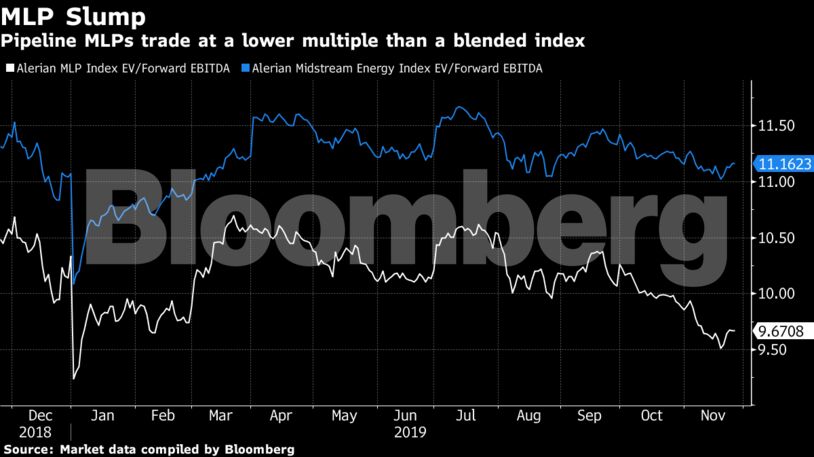

The Alerian MLP Index is down 9.3% this year. There’s a “slow, orderly bleed” of investors’ funds out of MLPs, CBRE Clarion Securities LLC portfolio manager Hinds Howard said in a recent post on his blog.

The one U.S. pipeline company structured as a REIT, CorEnergy Infrastructure Trust Inc., owns a number of pipelines, storage tanks and transmission lines across the U.S. Until recently, it leased those assets to oil producers and other companies in return for rental payments. But thanks to a February ruling from the IRS, CorEnergy can operate the same assets while keeping its tax-exempt status.

“The original thought we had was that institutional investors wanted to have a way to get access to energy infrastructure without owning MLPs,” Chief Executive Officer Dave Schulte said in an interview. “We found a new investor audience.”

REITs, like MLPs, are so-called pass-through entities, exempt from taxes as long as they pay out most of their income as dividends. But REITs tend to have corporate governance standards more akin to regular corporations, making them eligible for broader stock indexes and potentially opening them up to much larger pools of investor money. That contrasts with MLPs, which are often controlled by general partners that aren’t required to have a fiduciary obligation to common unitholders.

REITs have “greater accessibility for the stockholders,” Courtney Cochran Butler, a partner at Hunton Andrews Kurth, said in an interview in Houston. “They’re able to actually have a say in what’s going on at the company.”

| The ABCs of Corporate Structures | ||||

|---|---|---|---|---|

| MLPs | REITs | C-Corps | ||

| Corporate-level tax | Pass through | Pass through | Tax | |

| Tax filing form | K-1 |

|

1099 | |

| Suitable for IRA? | Not ideal due to UBTI* | Yes | Yes | |

| Required payout | None | 90% of income | None | |

| Foreign ownership | Limited | Easier | Easiest | |

| Source: RBC Capital Markets

* Unrelated Business Taxable Income |

||||

Despite the negative sentiment around MLPs, some of the biggest pipeline companies have stood by the partnership structure. Energy Transfer LP and Enterprise Products Partners LP repeatedly field questions about their status as MLPs, especially as their units underperform pipeline rivals.

Converting from an MLP to a REIT would be complicated, and any such move would likely follow smaller steps toward the structure. Pipeline operators could decide to spin off certain assets into REITs, said TJ Schultz, an analyst at RBC Capital Markets. And companies backed by private equity could view the REIT structure as a path to an initial public offering, he said.

There are also questions about which particular assets would be eligible for the REIT model. For example, processing plants probably don’t qualify, Schultz said.

Companies considering the REIT structure would be wise to wait until after they got their own private letter ruling from the IRS, according to Tommy Ford, a partner at Hunton Andrews Kurth and co-head of the law firm’s tax group.

“We don’t know of a transaction that’s teed up,” Ford said. “But I can tell you that the tax groups and the lawyers within the big companies are spending time analyzing it and thinking about how it might work for them.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein