By Simon Casey

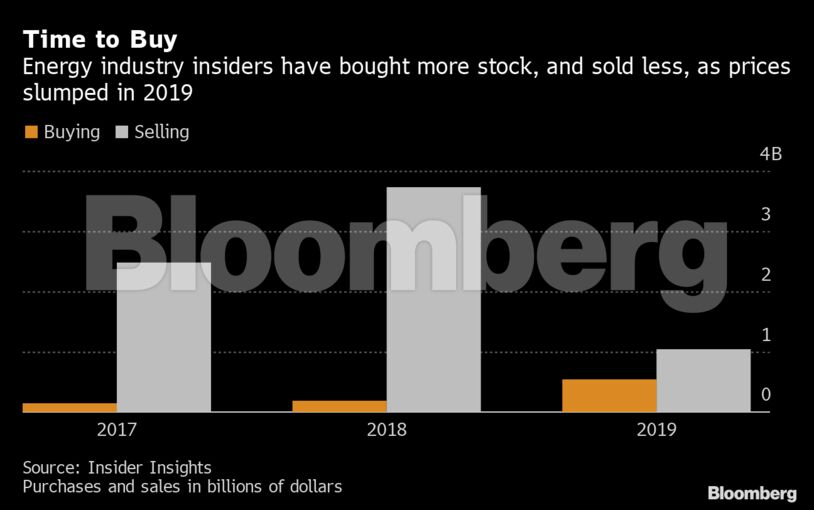

Energy companies have bombed in 2019 while the S&P 500 has rallied almost 25%. Stagnant oil and natural gas are partly to blame, but the U.S. shale industry is also getting squeezed by investors losing patience over disappointing returns. Oilfield-service companies and pipeline operators haven’t escaped the selloff.

Enter the moguls. Hamm, the billionaire founder of shale oil producer Continental Resources Inc., has been one of the very biggest insiders to buy up stock, spending $78.8 million to enlarge his controlling stake via purchases on the open market so far this year, according to data compiled by Bloomberg.

Warren, the chief executive officer and founder of pipeline operator Energy Transfer LP, last week disclosed he had reinvested dividends from his existing stake in the company by buying $45.1 million of common stock, his biggest-ever purchase, the data show.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS