By Alexander Weber

Officials in Brussels are trying to advance some of the most ambitious ideas how to police the market for green investments, one of the fastest growing areas in finance. With federal watchdogs in the U.S. mostly absent from the debate, the European Union efforts could end up as benchmarks for green finance around the world.

“The EU does believe it is a global leader here and that it’s going to help set a standard,” said Ilan Jacobs, co-head of European government affairs at Citigroup Inc. “There’s truth in that.”

While Europe had its share of regulatory missteps — including a huge money laundering scandal that exposed shortcomings in how its rules are implemented — it’s been at the forefront on issues where the U.S. has taken a hands-off approach. Incoming Commission President Ursula von der Leyen made climate change a cornerstone of her program, and central bankers from London to Frankfurt have moved green finance onto the agendas of their institutions.

Any green finance regulations agreed in Brussels would only apply in Europe, but rules made here had global ramifications before because corporations seeking access to the region’s 16 trillion-euro economy often find it easier to adopt its rules than to adjust to multiple regimes. In one example, Facebook Inc. and Microsoft Corp. said last year they’ll largely apply Europe’s new data-protection rules outside the continent as well.

The bloc’s new push aims to establish common definitions for green investments and to weed out misleading practices known as “greenwashing” — calling products sustainable even if they don’t really help fight climate change — which are often mentioned as an obstacle to further development of the market.

| When is an investment green? Europe’s taxonomy isn’t final, but here are some examples based on the latest proposals: |

| Agriculture: | Must reduce greenhouse gas emissions over time; land needs to increase carbon storage over a period of 20 years |

| Forestry: | Need to adhere to requirements such as maintaining biodiversity and increase carbon storage over a period of 20 years |

| Energy production from wind, solar and water: | Emissions over their whole lifecycle, including the production of the power plants, must remain below a limit that gradually falls to zero by 2050 |

| Rail transport: | Passenger trains must have no direct emissions or remain below a limit that’s significantly lower than the current average of European diesel trains |

At the heart of the plan is an effort to establish a catalog — also known as taxonomy — of what constitutes sustainable practices that qualify for green bonds, funds and other products. An expert group is examining what level of energy consumption and emissions is consistent with the Paris Climate Agreement. It has so far developed criteria for almost 70 economic activities, from electricity and manufacturing to transport and agriculture.

The group’s taxonomy could become the basis for new regulations by the end of 2022, though some investors are already using the draft criteria now to see if their holdings are green, according to Nathan Fabian, a member of the technical expert group. Once officially in place, investment funds that want to claim they contribute to environmental goals would have to disclose to what extent they are compliant with the European standards.

“This disclosure requirement would apply for any investment fund product issued in Europe, including by financial firms domiciled outside Europe,” Fabian said. “Investors will need data and so investee companies can expect to be asked to explain whether or not they meet the taxonomy criteria, even if company operations are based outside Europe.”

The impact could be potentially massive. More than $30 trillion of funds were held in sustainable or green investments at the start of 2018, the most recent figure available from the Global Sustainable Investment Alliance, which tracks such money flows in five regions across the globe. Almost half of that is domiciled in Europe.

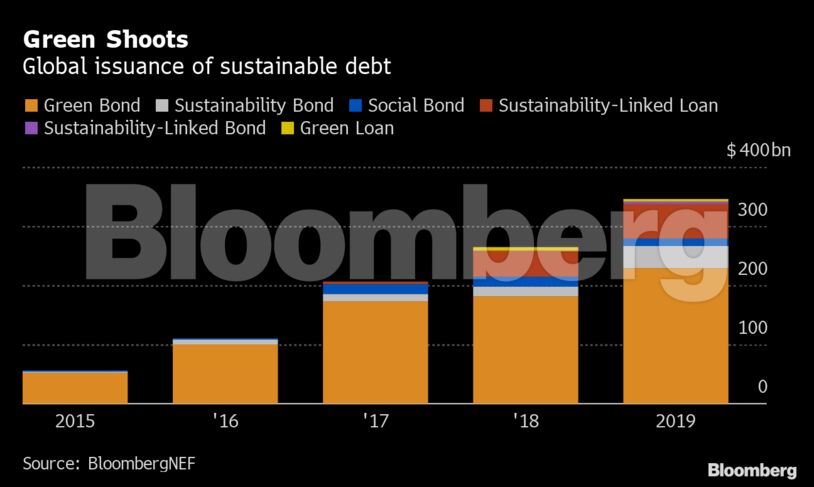

The taxonomy would also serve as the foundation for an EU green bond standard and potentially other product labels. Green bonds, which are issued specifically to fund environmentally friendly projects, are the simplest and most established form of sustainable finance. They made up the bulk of some $346 billion of sustainable debt issued globally this year, already surpassing last year’s record of $265 billion, according to BloombergNEF.

Europe’s goal in regulating green finance is to funnel more private funds into such products to stem the dizzying costs of the Paris Agreement. Europe needs as much as 290 billion euros ($319 billion) per year in additional financing to reach those targets, according to the EU executive. The United Nations Intergovernmental Panel on Climate Change has said that on the global level, an extra $830 billion in energy-related spending is needed each year until 2050 to limit global warming to 1.5 degrees Celsius.

Carney’s Push

In the longer term, the European system could find more applications, for example in public investment programs or central bank policies. Bank of England Governor Mark Carney has pioneered attempts to address the environmental risks to financial stability. European Central Bank President Christine Lagarde has said that the catalog could be applied to the institution’s asset purchases, though the idea is controversial.

Money managers say they’re in favor of common standards for green investments, as long as they’re not told how to run their funds or forced to immediately report green metrics for all of their holdings, said Steffen Hoerter, head of ESG at Allianz Global Investors.

Europe has also led the initiative to harmonize efforts at the global level, creating an “International Platform on Sustainable Finance” together with countries including China and Canada. China has been among the first nations to regulate green finance, though its practices are mainly focused on domestic objectives such as pollution and less on fighting global climate change.“We don’t want to have a prescription how we run our investment strategies,” said Hoerter, who is a member of the technical expert group that helped draft the current proposal. “What is quite good right now is that it’s voluntary.”

“Europe has the potential to build itself into a center of expertise to attract rising numbers of investors keen to place their funds and savings in green investment options,” Valdis Dombrovskis, the EU commissioner responsible for financial services, said at a Bloomberg event in Brussels earlier this month.

Brexit Hurdle

To be sure, the EU still has some hurdles to clear. Negotiators from the European Parliament and the national governments are in the final stretch of agreeing on the procedure for defining green investments. One of the sticking points in the discussions is whether nuclear energy can be seen as eligible or whether it should be ruled out from the start.

Brexit could also spell trouble for the EU’s leadership in this area. Once the U.K. leaves the bloc, it may come up with different rules than the classification system written in Brussels. There’s also the question of whether companies even report enough comparable data on the environmental impacts of what they do.

But the objective is clear, according to Bas Eickhout, a Dutch member of the EU assembly and one of the lead lawmakers on the file.

“The EU should try to have this standard in place as soon as possible and thereby lead the way globally,” he said in an email. “The EU is in a great position to become global standard setter here.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet