By Elizabeth Low and Alex Longley

Futures added as much as 1.3% in New York, after falling in the previous 2 sessions. China remains open to agreeing to a partial trade deal with the U.S., according to an official with direct knowledge of the talks.

Separately, Turkish troops have begun crossing into northeastern Syria to force back Kurdish militants, a Turkish official told Bloomberg, after President Donald Trump said the U.S. wouldn’t stand in the way. The dollar also declined.

“I would say it’s the trade news from China and with that the weaker dollar which is driving the recovery,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. “Turkish troop movements are likely to further reduce the selling appetite as it adds another geopolitical risk to an already long list.”

Oil prices have generally been on a downward trend after spiking in mid-September in the wake of Saudi Arabia’s energy industry. Concerns about demand linger amid a trade war and deteriorating relations between China and the U.S., the world’s two largest economies. In addition, the American Petroleum Institute on Tuesday reported U.S. crude stockpiles rose by 4.13 million barrels last week, according to people familiar with the data.

Despite the increase on Wednesday, prices are still down about 20% from their year-to-date peak in April. Crude is likely to fall further if the official Energy Information Administration figures due Wednesday also show a gain in American inventories.

Shell Says Supply Squeeze Won’t Fix Climate: Oil & Money Update

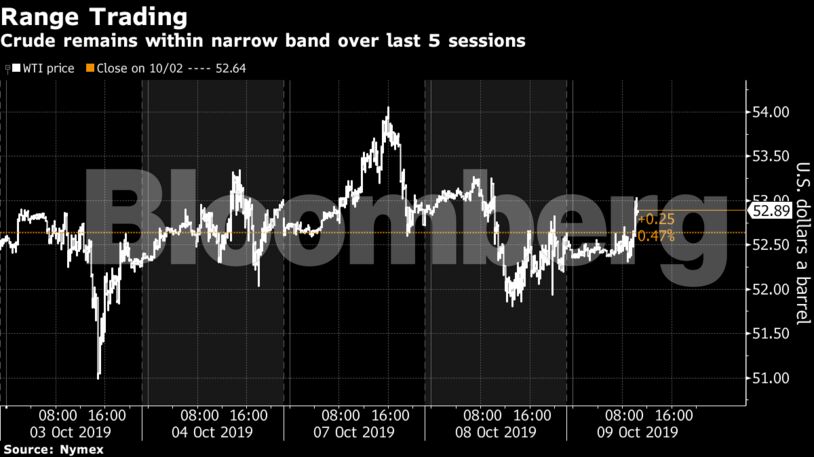

West Texas Intermediate for November delivery rose 59 cents to $53.22 a barrel on the New York Mercantile Exchange as of 11:19 a.m. London time. Earlier it rose as high as $53.33. The benchmark’s nearest timespread — a gauge of market strength — still remained near a bearish contango structure.

Brent for December settlement gained 71 cents, or 1.2%, to $58.95 a barrel on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a $5.62 premium to WTI for the same month.

Two days of U.S.-China trade talks start Thursday in Washington. While negotiators aren’t optimistic about securing a broad agreement that would end the trade war, China would accept a limited deal as long as the Trump administration doesn’t impose any more tariffs, according to an official who asked not to be named because the discussions are private.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS