By Elizabeth Low and Grant Smith

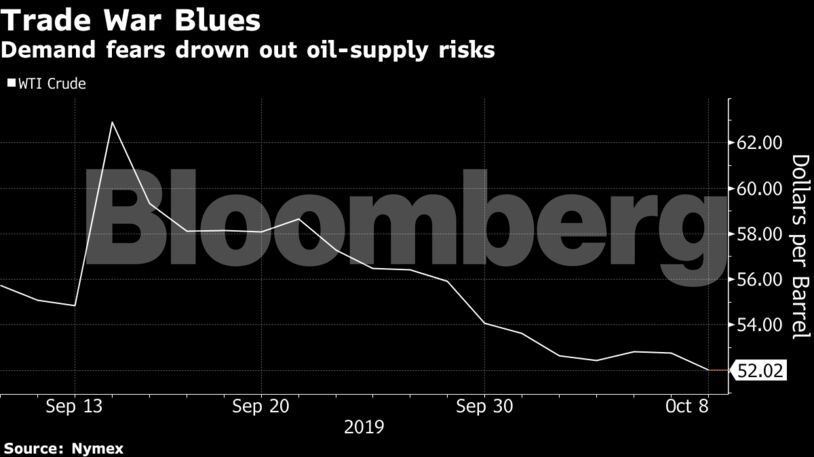

Futures in New York slipped as much as 1.7% following news that the White House is considering plans to potentially limit capital flows into China, while Beijing signaled it would retaliate after the Trump administration placed eight of the country’s technology giants on a blacklist over alleged human rights violations. That’s undermining the prospects of any breakthrough at this week’s talks between U.S. officials and Vice Premier Liu He, China’s chief trade negotiator.

Oil posted a second quarterly loss in the three months ended September as a global economic slowdown dented demand. The prolonged trade spat between Beijing and Washington has already almost halved oil consumption growth, Citigroup Inc. said last month, overshadowing the impact of attacks on oil facilities in Saudi Arabia and political protests in fellow OPEC member Iraq.

West Texas Intermediate for November delivery fell 67 cents to $52.08 a barrel on the New York Mercantile Exchange as of 12:38 p.m. London time. The contract fell 6 cents to close at $52.75 on Monday, near the lowest settlement level since early August.

Brent for December settlement declined 58 cents, or 1%, to $57.77 a barrel on the ICE Futures Europe Exchange after closing little changed on Monday. The global benchmark crude traded at a $5.71 premium to WTI for the same month.

“I see limited chance of a trade deal which may add some short term downside risks but overall I believe that enough supply uncertainty remains to prevent the market from collapsing,” said Ole Sloth Hansen, head of commodities strategy at Saxo Bank A/S in Copenhagen. “The geopolitical risk premium has completely been wiped out, and that does not make much sense given current developments.”

See also: Big Oil Is Selling Its Dirty Assets, But They Aren’t Going Away

Prices also remained capped by estimates of another increase in U.S. oil stockpiles. Inventories expanded by 1.95 million barrels last week, in what would be the longest run of gains since February, according to the median estimate in a Bloomberg survey.

U.S. crude stockpiles increased by 3.1 million barrels in the week ended Sept. 27 to 422.6 million, according to Energy Information Administration data. That was the third straight weekly increase, and the biggest weekly gain since May.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet