By Saket Sundria and Grant Smith

(Bloomberg)

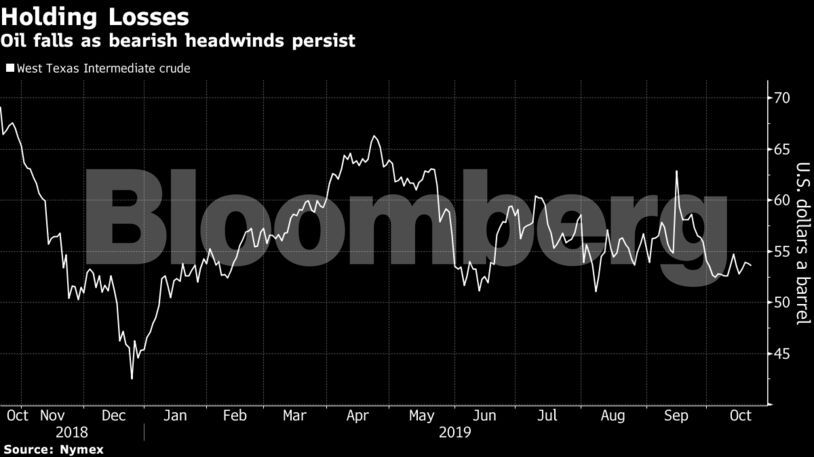

Oil fell again after a weekly loss amid ongoing concern that a fragile economic outlook will continue to weigh on fuel demand.

Futures fell 1% in New York after dropping 1.7% last week. Policy makers in China, the world’s second-biggest oil consumer, are preparing for two key meetings with fresh evidence that economic growth will slip further from its lowest in almost three decades. Speculators have almost tripled short positions in U.S. crude futures since mid-September as Washington and Beijing struggle to finalize a trade deal, according to data released on Friday.

Oil has declined 19% since an April peak even though markets were last month hit by the biggest-ever supply incident with the missile strike on Saudi Arabia’s Abqaiq plant, and continue to face crises from Iran to Venezuela and Iraq. Any fears over supply are being drowned out by the increasingly bleak economic outlook.

“The alarm bells for the global economy are ringing to the rhythm of doom,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London.

WTI for November delivery fell 51 cents to $53.27 a barrel on the New York Mercantile Exchange as of 10:24 a.m. in London. The contract lost 15 cents to close at $53.78 on Friday, capping a 1.7% weekly loss.

Brent for December settlement fell 67 cents to $58.75 a barrel on the London-based ICE Futures Europe Exchange. The contract fell 49 cents to $59.42 on Friday. The global benchmark crude traded at a $5.34 premium to WTI for the same month.

See also: Saudi Arabia’s Best Bet Is to Crash the Oil Price: Julian Lee

Short-selling of WTI has climbed to 114,709 futures and options, from just 39,948 in the week ended Sept. 17, according to U.S. Commodity Futures Trading Commission data. Net-long positions, or the difference between the long and short positions, shrank 8.8%.

“The market longs for better macro data and a further weakening of the U.S. dollar before it will turn positive on the outlook for the oil market,” said Jens Naervig Pedersen, a senior analyst at Danske Bank A/S in Copenhagen.

| Other oil market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS