By Heesu Lee and Alex Longley

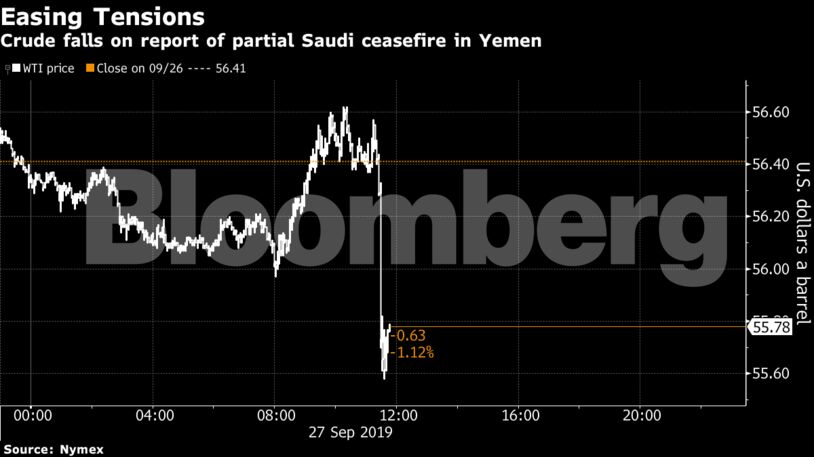

Futures declined as much as 1.5% in New York. Saudi Arabia has agreed to a cease-fire in four areas in Yemen, including San’a, Dow Jones reported, citing unidentified people familiar with the plans. Crude had already been heading for a weekly decline as OPEC’s largest producer is about a week ahead of its repair schedule following attacks last week and is pumping more than 8 million barrels a day, according to people familiar with the matter.

While the return of production in Saudi Arabia has weighed on prices this week, the decline also reflects a deepening manufacturing slump in Germany, more signs of economic weakness in China and rising crude stockpiles in the U.S. The potential cease-fire in Yemen will likely help to cool growing political tensions in the region, after the attacks on Saudi oil infrastructure on Sept. 14 knocked out 5% of global production and resulted in the U.S. planning to move more troops to the region.

If a cease-fire is agreed “then we should return to $60 as we are back to focusing only on growth and demand worries,” said Ole Hansen, head of commodities strategy at Saxo Bank.

West Texas Intermediate for November delivery declined 62 cents to $55.79 a barrel on the New York Mercantile Exchange at 11:51 a.m. London time.

Brent for the same month dropped 91 cents, or 1.5%, to $61.83 a barrel on the ICE Futures Europe Exchange, and traded traded at a $6.05 premium to WTI.

The U.S., Saudi Arabia and major European powers have all blamed Iran for the attacks, though Tehran has denied the allegations. Houthi rebels, which the Saudis are battling in Yemen, have claimed responsibility for the assault.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS