By Katia Dmitrieva Faster inflation may strengthen the hand of those policy makers who are reluctant to keep lowering borrowing costs following last month’s quarter-point reduction, as employment and consumer spending remain solid. At the same time, the latest ratcheting-up of U.S.-China trade tensions and a deepening global economic slowdown are weighing on the outlook, with investors pricing in two to three more moves this year.

Following the report, traders trimmed slightly the amount of Fed easing they have priced in for this year while the 10-year Treasury yield climbed to its high for the day. Those moves were amplified later in the morning, and stocks surged, after the U.S. delayed tariffs on a range of consumer goods from China by more than three months, to Dec. 15.

Policy makers have struggled to lift inflation toward their 2% target, which is based on a separate Commerce Department index that tends to run slightly below the Labor Department’s CPI. President Donald Trump has repeatedly cited low inflation in his attacks on the Fed and calls for deeper interest-rate cuts, and he tweeted after the CPI data that the tariffs aren’t actually boosting prices.

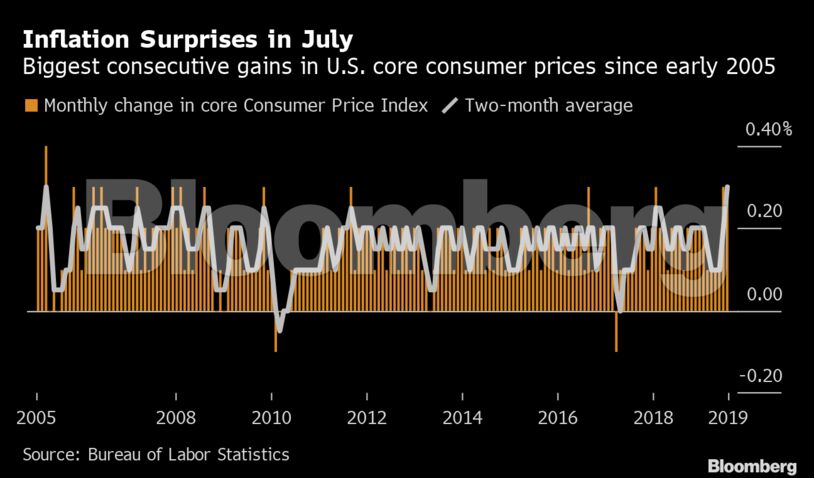

“While a few details suggest that the pace overstates the trend, it is clear tariffs are beginning to drive goods prices higher,” Sarah House, a senior economist at Wells Fargo & Co., said in a note Tuesday. The 2.2% annual gain in the core CPI followed 2.1% in June and marked the fastest increase since January. The index rose an annualized 2.8% over the past three months, the most since early 2018. The two-month gain of 0.6% was the most in more than a decade.

“Firming core CPI in July is challenging the Fed’s view that a return to its 2% inflation target would take longer than previously projected.” While the Fed officially targets inflation including all items, policy makers look to the core measures for a better sense of the underlying trend because food and energy prices tend to be volatile.

Many key measures within the Labor Department’s gauge advanced in July. Shelter costs, which make up about a third of total CPI, rose 0.3% for a second month, while medical care was up 0.5%, apparel advanced 0.4% and used cars and trucks rose 0.9%.

Prices for new vehicles fell 0.2%, the first decline since February.

Energy prices rose 1.3% from the prior month as gasoline prices increased 2.5%. A national gauge of retail gasoline prices was up on average during the month though it has declined since mid-July. Food costs were unchanged for a second month.

What Bloomberg’s Economists Say

— Yelena Shulyatyeva and Eliza Winger

Click here for the full note.Get More

Share This:

U.S. Core Inflation July 2019: Hits Six-Month High

These translations are done via Google Translate

These translations are done via Google Translate(Updates with markets and latest tariff developments in fourth paragraph, adds economist comment in fifth paragraph, adds Bloomberg Economics comment.)

FEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet