By Grant Smith and Sharon Cho

Oil has whipsawed between gains and losses this month as concerns about the impact of the U.S.-China trade war compete with a pledge from Saudi Arabia to stem the price rout. Washington said it was delaying until mid-December the tariff on some Chinese-made products, while phone talks between the two sides are scheduled in two weeks.

“Yesterday was an eye opener on how much global growth fear hides in oil prices,” said Norbert Ruecker, head of economics at Julius Baer Group Ltd. in Zurich. “The trade conflict has escalated and the latest batch of tariffs will bear economic costs.”

West Texas Intermediate crude for September delivery fell as much as $2.20, or 3.9%, to $54.90 a barrel on the New York Mercantile Exchange, trading for $55.20 as of 8:32 a.m. local time. The contract surged $2.17, or 4%, on Tuesday to settle at $57.10 in its biggest advance since July 10, after the U.S. postponed tariffs on some Chinese goods.

See also: Oil Market’s Key Trade Whipsawed by Pipeline Starts, Trade War

Brent for October settlement decreased $1.84, or 3%, to $59.46 on the ICE Futures Europe Exchange. The contract closed 4.7% higher Tuesday, the largest gain since Dec. 26. The global benchmark crude traded at a $4.31 premium to WTI for the same month.

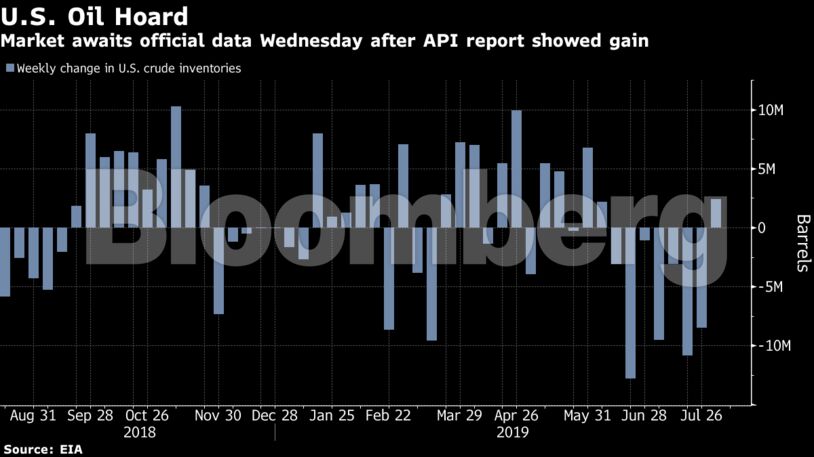

U.S. crude stockpiles unexpectedly rose by 2.4 million barrels in the week ended Aug. 2, climbing from the lowest level since November for the first gain in eight weeks. The median estimate in the Bloomberg survey forecasts the Energy Information Administration will report a decline of 2.5 million barrels for the week ended Aug. 9, with 11 of the 13 analysts forecasting a drop.

President Donald Trump bowed to pressure from U.S. businesses and concerns over the economic fallout of his trade war with China, delaying the imposition of new duties on a wide variety of consumer products such as toys and laptops until December.

“It is difficult for any meaningful rally in this risk-off environment and the potential increase in U.S. inventories adds further bearishness,” said Howie Lee, a Singapore-based economist at Oversea-Chinese Banking Corp. “We have been here before — the on-off trade talks — and everyone remains skeptical.”

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS