By Heesu Lee and Grant Smith

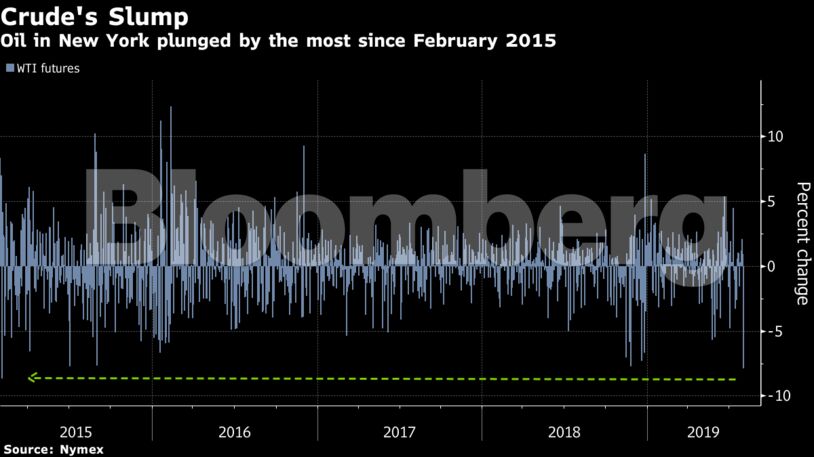

While futures in New York rebounded on Friday, prices are still far from recovering Thursday’s 7.9% slump, the most since February 2015. Trump said 10% levies will be imposed Sept. 1 on $300 billion of Chinese goods after a round of trade talks ended without a breakthrough. The threat compounded fears about declining American manufacturing activity after the Federal Reserve dashed prospects for a series of rate cuts to boost growth.

Oil has been caught between concerns the global demand may slow and fears Middle East crude flows could be disrupted. Output from the Organization of Petroleum Exporting Countries slid in July to the lowest in five years as U.S. sanctions on Iran crimped exports from the Persian Gulf nation. However, an escalating trade war’s impact on the world economy remains the primary focus.

“Concerns of cooling consumption remain top of mind in the oil market, offsetting the jittery supply situation and weighing on the market mood,” Carsten Menke, an analyst at Julius Baer Group Ltd., said in a report.

West Texas Intermediate oil for September delivery added $1.21, or 2.%, to $55.16 a barrel on the New York Mercantile Exchange as of 1:47 p.m. in London. The contract slid $4.63 on Thursday and is down 1.9% this week.

Brent for October settlement gained $1.53 to $62.03 a barrel on the ICE Futures Europe Exchange. Front-month prices are down 2.1% this week. The premium of the October contract over November climbed to 55 cents a barrel, a sign of short-term market strength. The benchmark global crude traded at a premium of $6.80 to WTI for the same month.

See also: WTI May Test $50/Bbl on New Trump Tariff Threat, Strategists Say

America’s new import taxes, which Trump later said could go “well beyond” 25%, will be imposed on a long list of goods expected to include smart-phones and laptop computers. They will come on top of the 25% duty already in place on some $250 billion in Chinese goods and mean that almost all trade with Beijing will be subject to new taxes. China had pledged “countermeasures.”

“The souring U.S.-China trade war confirms the oil market’s worst fears on oversupply,” said Vandana Hari, founder of Vanda Insights in Singapore. “If it all goes downhill from here, attention will shift back on OPEC+ to see if the producers will act to deepen their cuts before the current deal expires.”

| Oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS