By Serene Cheong and Alfred Cang

Zhuhai Zhenrong Co., the secretive company with links to the Chinese military, has a history of taking Iranian crude and fuel, at times as part of barter deals for goods or services, and then selling it on to refiners in China. The U.S. move comes at a delicate time for relations with Beijing as the two nations attempt to kick-start negotiations aimed at resolving their broader trade conflict.

Secretary of State Michael Pompeo announced the decision in a speech Monday, adding that sanctions would also be imposed on the company’s chief executive officer, Li Youmin.

“They violated U.S. law by accepting crude oil” from Iran, Pompeo said. “We’ve said all along that any sanction will indeed be enforced.”

Specifically, the company “knowingly engaged in a significant transaction for the purchase or acquisition of crude oil from Iran” after restrictions were fully in place on May 2, the state department said in a separate statement.

Li declined to comment when reached by Bloomberg News on Tuesday. The trading company merged in 2015 with Macau, China-based Nam Kwong Group, which said Tuesday that it separated from Zhuhai Zhenrong in September.

“The company mainly handles crude, oil products and other products and services trading with Iran through barter system, so the U.S sanctions has very limited impact,” said Seng Yick Tee, an analyst at Beijing-based SIA Energy.

Tensions between Iran and the U.S. have intensified since the Trump administration backed out of the deal aimed at curbing Tehran’s nuclear program and reimposed sanctions. China, which is increasingly reliant on energy imports, reiterated its criticism of the restrictions on Tuesday, with Foreign Ministry spokeswoman Hua Chunying calling them a violation of international law.

Bonded Storage

The sanctions against Zhuhai Zhenrong also come amid signs that Iran has been able to skirt U.S. efforts to curb exports.

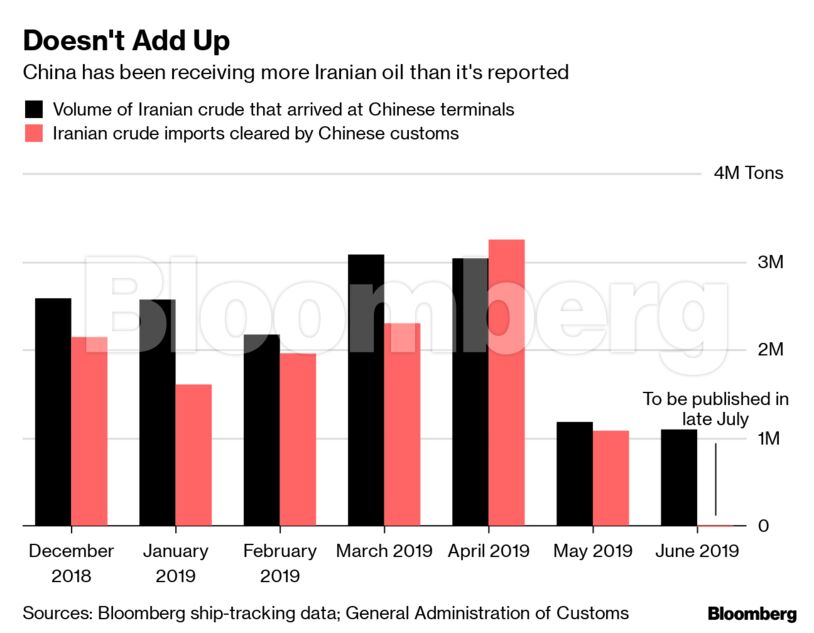

Iranian crude is still making its way to China, but being placed in bonded storage rather than passing through customs, according to people familiar with the operations at several Chinese ports. That’s creating a hoard of crude sitting on the doorstep of the world’s biggest importer.

And there could be more Iranian oil headed for China’s bonded storage tanks, Bloomberg tanker-tracking data show. At least 10 very large crude carriers and two smaller vessels owned by the state-run National Iranian Oil Co. and its shipping arm are currently sailing toward the Asian nation or idling off its coast. They have a combined carrying capacity of over 20 million barrels.

There is no indication that Zhuhai Zhenrong is involved in these trades.

Before waivers for Iranian oil purchases expired in early May, China was the No. 2 destination for its oil exports, receiving 267,000 barrels a day in April, according to Bloomberg ship-tracking data. India was the top buyer that month, lifting 333,000 barrels a day.

Zhuhai Zhenrong’s imports from Iran averaged about 156,000 barrels a day in the first five months of this year, according to SIA Energy’s Tee. That’s down from as high as 221,000 barrels a day in 2015.

The company could potentially continue to take Iranian oil despite U.S. efforts, Fereidun Fesharaki, chairman of industry consultant FGE, said in April. He estimated that Iran could continue selling about 200,000 barrels a day to the Chinese trader despite the restrictions.

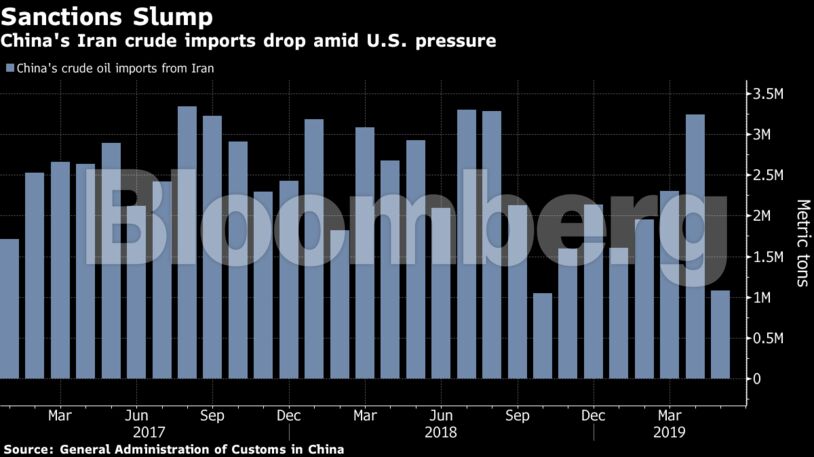

China’s crude oil imports from Iran in May declined 67% on-month to 1.08 million tons (about 255,000 barrels a day), according to statistics by the country’s customs authority. China’s official country-level import data for June is scheduled to be released this week.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire