By Saket Sundria and Grant Smith

Futures in New York traded little changed after climbing 1.7% over the past two sessions. Secretary of State Michael Pompeo said Monday that the U.S. had sanctioned a Chinese state-run oil trader for violating White House-imposed restrictions on Iranian crude. Meanwhile, U.K. Foreign Secretary Jeremy Hunt announced that European governments will assemble a naval mission to provide safe passage for ships through the gulf after Iran seized a British tanker.

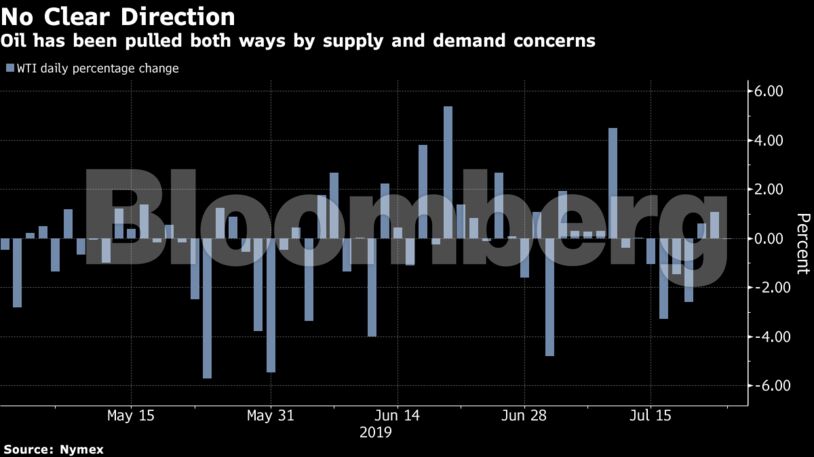

The renewed tension around the Strait of Hormuz, through which around a third of the world’s seaborne oil flows, comes after five straight weeks of declines in American crude inventories tightened the supply picture. Yet a weak global demand outlook — with few signs the U.S.-China trade war will be resolved soon — are keeping oil prices from rising further.

“While the tensions in the Middle East have not yet resulted in any supply disruptions, the latest incidents should remind investors that the situation is fluid and tensions could flare up again,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich.

West Texas Intermediate for September delivery edged up 5 cents, or 0.1%, to $56.27 a barrel on the New York Mercantile Exchange as of 10:14 a.m. London time. The August contract climbed 1.1% on Monday as it expired.

Brent for September settlement was unchanged at $63.26 a barrel on the ICE Futures Europe Exchange, after rising 1.3% on Monday. The global benchmark was trading at a $6.95 premium to WTI.

The U.S. penalized Zhuhai Zhenrong Co., a company with links to the Chinese military, for accepting oil from Iran. “We’ve said all along that any sanction will indeed be enforced,” Pompeo said in a speech Monday.

Britain doesn’t want to escalate tensions with Iran and won’t be taking part in the White House’s “maximum pressure” policy, the U.K.’s Hunt said as he announced the European naval mission. Iranian Deputy Foreign Minister Abbas Araghchi is traveling to France to meet President Emmanuel Macron as the crisis complicates Europe’s efforts to save the 2015 nuclear accord.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS