By Heesu Lee and Alex Longley

Futures fell 0.2% in New York after closing 1.1% higher on Monday. OPEC ministers agreed to maintain production curbs for another nine months, and their allies are expected to ratify the deal on Tuesday. Still, a slew of disappointing manufacturing reports from the U.S., China and Europe continued to shake faith in oil demand. Trade concerns resurfaced after Washington proposed more tariffs on European Union goods in retaliation for aircraft subsidies.

Oil has rallied since mid-June as tensions escalated in the Middle East and on signs of progress in resolving the U.S.-China trade war. While announcing the extension of the Organization of Petroleum Exporting Countries’ production curbs into 2020, Saudi Arabian Energy Minister Khalid Al-Falih signaled that the group may have a long fight on his hands as American production booms. Forecasts for sluggish demand growth are also a concern for producers.

“Some might go as far as to say that yesterday’s performances were not only disappointing but even red flags have gone up,” said Tamas Varga, analyst at brokerage PVM Oil Associates Ltd. “Although a truce has been called between U.S. and China, global manufacturing is in a very bad shape.”

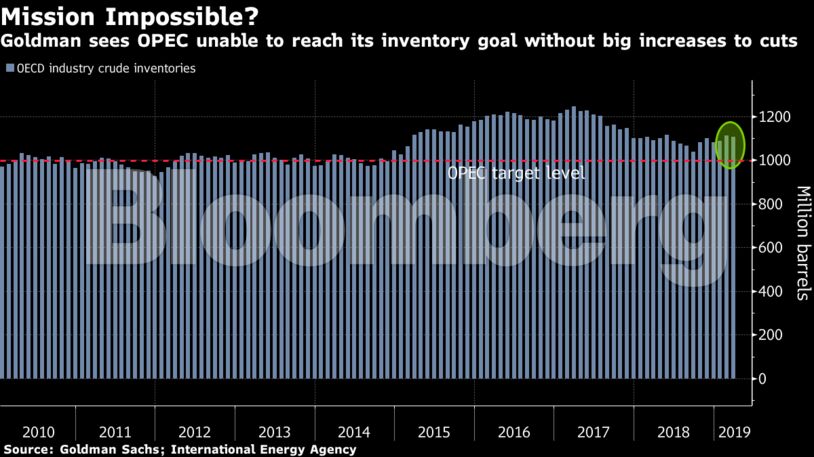

The OPEC agreement is leaving the door open for U.S. shale producers to grab more market share as it will have to cut deeper to achieve its inventory targets, according to Goldman Sachs Group Inc. The decision creates a clearer downside risk to the bank’s forecast for Brent to average $60 a barrel next year, even though it could result in some shorter-term price spikes.

West Texas Intermediate crude for August delivery slipped 12 cents to $58.97 a barrel on the New York Mercantile Exchange as of 10:39 a.m. in London.

Brent for September settlement declined 11 cents, or 0.2%, to $64.95 a barrel on the ICE Futures Europe Exchange, after adding 0.5% on Monday. The global benchmark crude was at a $5.89 premium to WTI for the same month.

The structure of the Brent crude market suggests futures investors may be losing faith that the OPEC+ extension will be enough to stave off a looming oil surplus as demand wanes. The premium of front-month futures over the next month reached as little as 23 cents on Tuesday, compared with 43 cents early on Monday. A shrinking premium, or backwardation, indicates a weakening near-term market.

A gauge of U.S. factory activity fell for a third month in June. The Institute for Supply Management index dropped to 51.7, the weakest level since October 2016. That came after the Caixin China PMI Manufacturing measure dipped below 50 for the first time in four months.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS