By Alex Longley

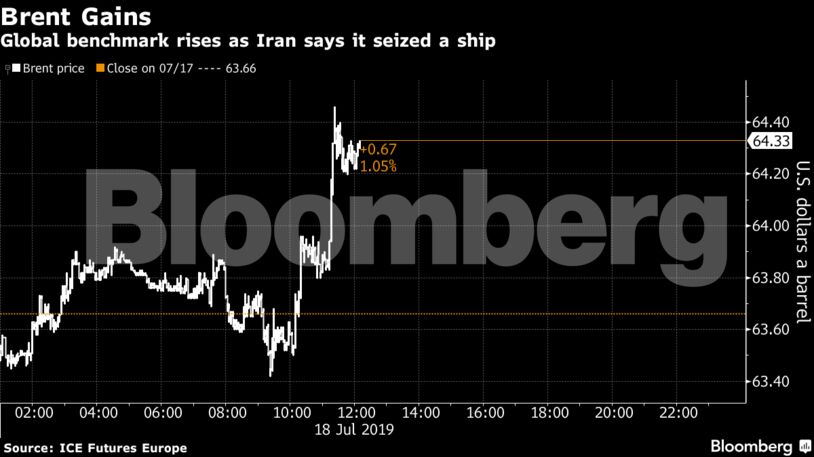

Brent crude gained as much as 1.3%, reversing some of the heavy losses the global benchmark suffered in the previous two sessions. Iran’s Revolutionary Guards said it captured a foreign vessel on July 14 alleged to be smuggling 1 million liters of fuel in the Persian Gulf, according to state-run Press TV news channel. It was unclear whether the report was referring to the Riah, a small ship that entered Iranian waters and stopped transmitting its location around the same time.

Oil has fallen this week as the specter of a renewed U.S-China trade conflict dents the demand outlook, while U.S. fuel stockpiles jumped. Still, the possibility of crude flows being disrupted from the Middle East remains in focus after Iran’s Foreign Minister Mohammad Javad Zarif said his country was capable of shutting crucial oil-shipping route the Strait of Hormuz, but is unwilling to do so.

“It’s a small move considering how much prices have fallen this week,” said UBS Group AG analyst Giovanni Staunovo. “At least we know where the tanker is, in contrast to a few days ago.”

Click here for the full interview with Iran’s foreign minister.

West Texas Intermediate for August delivery rose 38 cents to $57.16 on the New York Mercantile Exchange as of 12:32 p.m. London time. September Brent advanced 52 cents to $64.18 on the ICE Futures Europe Exchange. The global benchmark crude traded at a premium of $6.88 to WTI for the same month.

In an interview with Bloomberg Wednesday, Iran’s Foreign Minister Javad Zarif said the U.S. “shot itself in the foot” by pulling out of the nuclear accord with his nation. As tensions in the region continue to escalate, CNN reported that the U.S. is preparing to send 500 troops to Saudi Arabia. The U.S. is also set to brief foreign diplomats on a plan to boost maritime security in the region this week, special representative for Iran Brian Hook, said Tuesday.

Prices had been under pressure earlier on Thursday after U.S. gasoline stockpiles increased by 3.57 million barrels last week in data released Wednesday by the Energy Information Administration, the first rise in five weeks. The median estimate in the survey forecast a 2.4 million-barrel drop. Distillate inventories rose by 5.69 million barrels, while crude supplies fell by 3.12 million barrels.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS