Offshore oil and gas platforms. Photographer: Tim Rue/Bloomberg

HSBC Holdings Plc is expecting oil and gas deals to make up a smaller part of its energy portfolio, as renewables look to be the preferred way to feed data centers powering artificial intelligence.

Finance for fossil fuels will likely rise in absolute terms, but “decline materially” relative to HSBC’s overall capital allocations to the energy sector, Julian Wentzel, the UK bank’s chief sustainability officer, said in an interview. That’s due to “new energy systems coming on stream” over time, he said.

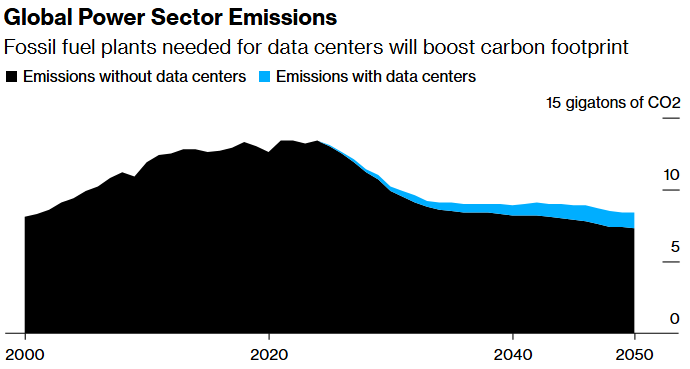

The comments are the latest to reflect how AI’s insatiable thirst for energy is reshaping capital allocations at major banks and asset managers. And while AI data centers are underpinning a revival of the green energy sector, they’re also feeding demand for oil, gas and even coal, which is ultimately making it harder to rein in emissions.

Source: BloombergNEF

Note: Forecast starts after 2024

Against that backdrop, HSBC unveiled less ambitious targets for the carbon footprint of the financing it does. Instead of cutting absolute financed emissions by 34% by 2030, the bank now says it targets a reduction of somewhere between 14% and 30% by the end of the decade, compared with a 2019 baseline.

The bank disclosed the new targets in an updated version of its so-called transition plan, which was published on Thursday. Instead of aligning its high-carbon portfolio with a pathway for future emissions that limits global warming to 1.5C, the bank is now working within a target range with an upper bound of 1.7C.

In its latest report on global warming, the United Nations Environment Programme said the world is on track for temperature rises of 2.8C assuming current climate policies are implemented.

HSBC said its less ambitious emissions targets reflect “the realities of an evolving transition playing out very differently across the global economy,” and is intended to ensure the bank “remains responsive to the global context our customers operate” in.

To ignore the fact that the world is way off course from UN climate goals would be “disingenuous,” Wentzel said.

Julian Wentzel Source: HSBC Holdings Plc

ShareAction, a London-based nonprofit, described HSBC’s updated targets as “an egregious example of backtracking on climate that responsible investors will not tolerate.” The new transition plan “opens the door to new clients making large investments in oil and gas exploration” and “dilutes the ambition of the bank’s climate targets,” said Louise Marfany, director of financial sector standards at ShareAction.

Wentzel, who was appointed chief sustainability officer in February after overseeing HSBC’s global banking business for the Middle East, North Africa, and Turkiye, said fossil-fuel restrictions aren’t on the agenda.

“We all have to acknowledge that creating prohibitions or not acknowledging the reality of the environments we serve and the reality of the challenges that we have from an energy system don’t serve the transition,” he said. “We have to acknowledge that the removal of capital from the oil and gas sector doesn’t support the transition, because if they’re seeking to transition, we want to be party to and support that transition.”

HSBC said its new financed emissions target is still aligned with the goals of the Paris Agreement, but that it also “recognizes the inherent uncertainties that will continue to influence the pace of decarbonization across different sectors.”

AI is set to drive up the supply of all forms of energy, but renewables ultimately look better placed than fossil fuels to benefit, Wentzel said.

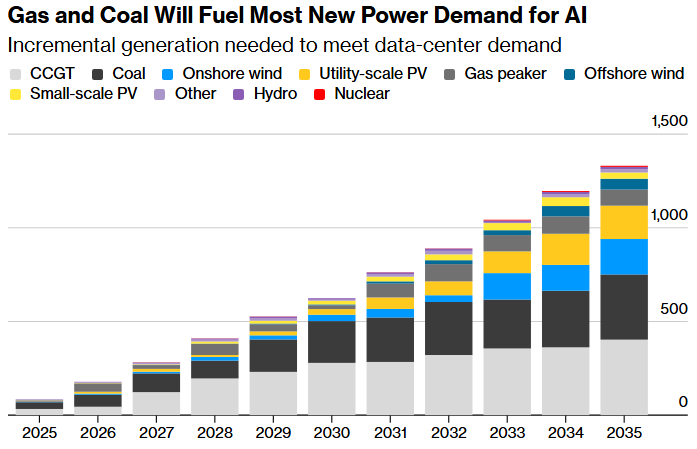

Source: BloombergNEF

Note: CCGT is combined cycle gas turbine, PV is photovolatic.

AI is a “huge shot in the arm” for low-carbon energy, he said. “This is a huge catalyst to the transition: It just takes too long to build the baseload required to deliver the energy requirement, so it’ll have to come through renewable sources,” said Wentzel. The resulting new energy system will be “very positively skewed to sustainable outcomes.”

Electricity demand tied to AI is on track to quadruple within a decade, with data centers on course to consume 1,600 terawatt-hours by 2035, or about 4.4% of global electricity. Renewables will play a major role in powering that development, though fossil fuels, especially gas, will also be a big part of the mix, pushing up emissions in the process, according to BloombergNEF.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS