By Ron Bousso

- TotalEnergies acquires 50% in Czech energy company EPH’s power business

- French company aims to grow power business while also increasing oil and gas

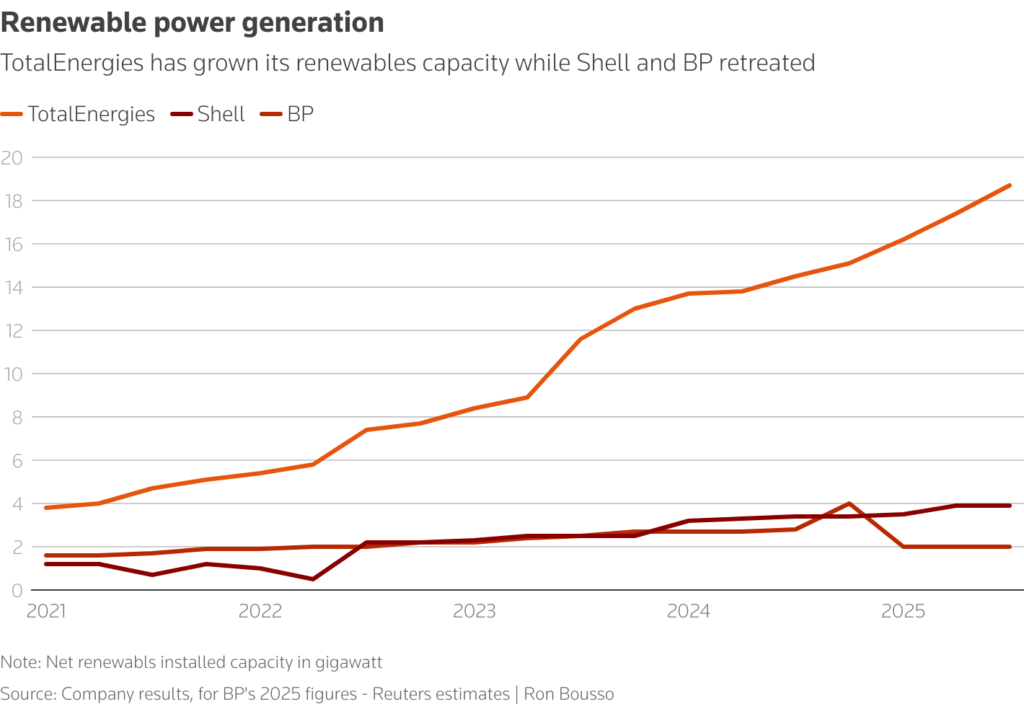

- Strategy contrasts with Shell and BP that scrapped most renewables plans

LONDON, Nov 18 (Reuters) – France’s TotalEnergies (TTEF.PA) is betting big on power and renewables, positioning itself to ride the global electricity demand wave and offer investors a clear alternative to rivals doubling down on oil and gas.

European oil companies’ strategies have seesawed since 2022, when Russia’s full-scale invasion of Ukraine and the related sanctions created an energy shock that made governments focus more on near-term energy security than the long-term energy transition.

The changing landscape led Shell (SHEL.L) and BP (BP.L) to ditch plans to plough billions of dollars into renewables and instead refocus on their legacy operations, aligning with U.S. rivals Exxon Mobil (XOM.N) and Chevron (CVX.N).

At the same time, TotalEnergies CEO Patrick Pouyanne defied investor pressure and largely stuck to a strategy first outlined in 2020 that strikes a balance between growth in core oil and gas operations and diversification into power and renewables.

That strategy was on full display on Monday when TotalEnergies announced the acquisition of a 50% stake in Czech energy company EPH’s Western European power generation platform in a 5.1 billion euro ($5.92 billion) all-stock transaction.

EPH, majority-owned by Czech billionaire Daniel Kretinsky, has more than 14 gigawatts of flexible capacity in operation or under construction, including gas-fired and biomass power plants and battery systems in Italy, France, the Netherlands and Britain.

The deal more than doubles TotalEnergies’ gas and biomass generation capacity to 13.5 GW, making it one of the largest producers in Europe.

The company expects the deal to boost cashflow by $750 million per year over the next five years while also reducing annual capital expenditures by $1 billion to between $14 billion and $16 billion, as the French energy major will not need to invest in building new power capacity.

Renewable power generation

POWER PLAY

TotalEnergies aims to generate 100 to 120 terawatt hours of electricity globally by 2030, compared with 41 TWh in 2024, mainly by expanding solar and wind power. That equates to over 4% of the European Union’s annual consumption.

To be sure, TotalEnergies has slowed investments in renewables and power in recent years in the face of soaring oil and gas prices and weakening returns on solar and wind. The company in September said it will cut annual spending on its integrated power business by 20-40% to between $3 billion and $4 billion.

And TotalEnergies’ power business is still far smaller than its core oil and gas businesses, which accounted for around 88% of adjusted net income of $4.7 billion in the third quarter.

But when it comes to growth rates, power takes the prize. While oil and gas production is expected to increase by 3% per year by 2030, TotalEnergies aims to grow its gross installed renewables power generation three-fold from current levels to 100 GW by the end of the decade.

In Europe alone, following the EPH deal, TotalEnergies aims to grow gas and biomass generation by 40% between now and 2030 to 35 TWh and more than triple current renewables and batteries capacity over the same period to 20 GW and 7 GW, respectively.

By comparison, Shell and BP have sold or spun off most of their renewable power generation assets in recent years. Shell had a mere 4 GW of net renewable generation by the end of September, compared with 19 GW for TotalEnergies. Exxon and Chevron have modest plans to invest in gas-fired power generation in the United States.

Italian energy group Eni (ENI.MI), like its French rival, has stuck to its energy transition strategy, though it took a unique path by spinning off its renewables and retail arm into a standalone business to attract external investment. The business, Plenitude, aims to almost triple its renewables generation capacity to 15 GW by 2030.

Oil majors’ share performance

‘IT TAKES TIME’

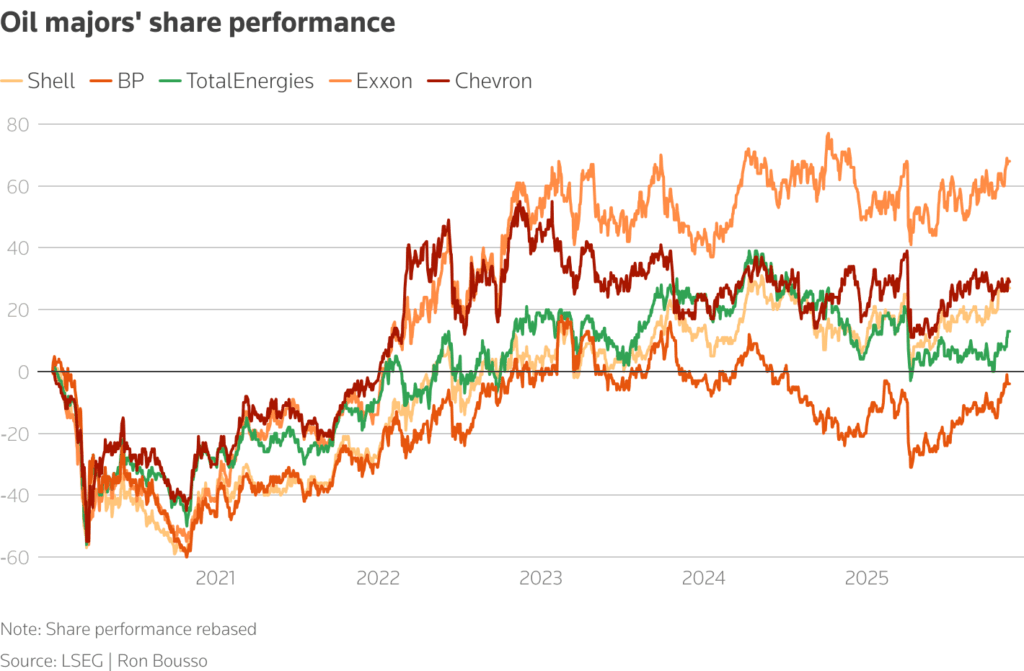

Investors have so far responded coolly to TotalEnergies’ strategy. Its shares have risen some 14% since 2020, compared with gains of 67% for Exxon, 29% for Chevron and 27% for Shell, while BP’s shares lost 3% over the period.

Pouyanne recently said he aims to increase TotalEnergies’ power business “step by step” in order to keep pace with the expected growth in electricity consumption from electric vehicles and data centres.

“The transition will happen, but it takes time,” Pouyanne told the Energy Intelligence Forum in October.

TotalEnergies has never had the flashiest clean energy strategy – as it has always sought to continue growing its legacy oil and gas business even as it pivots to power and renewables. But that steady realism may be just what the energy transition needs.

Ron Bousso; Editing by Sonali Paul

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS