By Ron Bousso

- Investment in low-carbon energy to reach $2.2 trillion this year

- Global renewable power capacity is forecast to double by 2030

- Trade tensions to nevertheless slow the energy transition

LONDON, Nov 20 (Reuters) – Stalled climate negotiations at COP30 and stubbornly high fossil fuel demand reflect the growing market consensus that the energy transition has slowed. But the risk now is that investors lose faith in a green shift that is continuing to move in one direction.

The two-week climate summit in Belem, Brazil, is coming to an end, and leaders have been struggling to hammer out a deal as huge gaps remain between countries on pretty important issues – like whether to move away from fossil fuels at all.

Much has changed since 195 governments sealed the landmark Paris agreement to battle climate change ten years ago. The world’s shift away from fossil fuels was rattled by the energy price shock following the war in Ukraine, economic challenges in the wake of the Covid-19 pandemic,

U.S. President Donald Trump’s retreat from clean energy policies and political polarization globally.

This does not mean the energy transition has not moved forward, but it is doing so in a more fractured manner than signers of the Paris agreement expected.

This changing sentiment was on full display last week when the IEA unveiled a new outlook showing that oil and gas demand – which was previously expected to peak in the 2030s – may continue rising into the 2050s based on current government policies.

The IEA’s Current Policies Scenario (CPS), which was produced following fierce criticism by Trump’s pro-fossil fuel administration, assumes climate policies and regulations will either be frozen or, in some cases, reversed in the coming decades.

Many of the CPS’s assumptions are highly questionable, such as the expectation of a sharp slowdown in global sales of electric vehicles and smaller gains in petrol car efficiencies.

A far more realistic scenario may be found in the agency’s Stated Policies Scenario (STEPS), which takes into account existing policies as well as those not yet turned into law that are viable under current market and economic conditions.

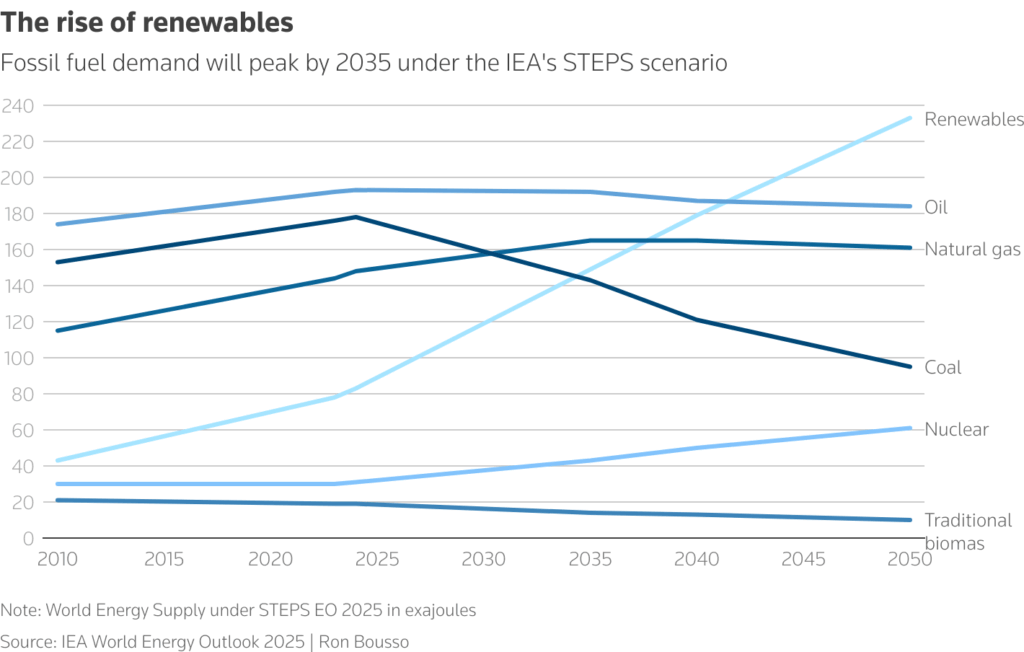

Under STEPS, coal consumption would peak before 2030, with oil demand rising by 2% between now and 2030 to 102 million barrels per day, before gently declining. Natural gas demand would level off after 2035.

This assumes that EV sales rise from over 20% of total vehicle sales today to more than 50% by 2035, displacing 10 million bpd of oil consumption.

At the same time, STEPS also assumes that renewables, which today account for one-third of electricity generation, will represent over half by 2035 and two-thirds by 2050. This would be achieved mostly from solar and wind penetration with the support of battery storage.

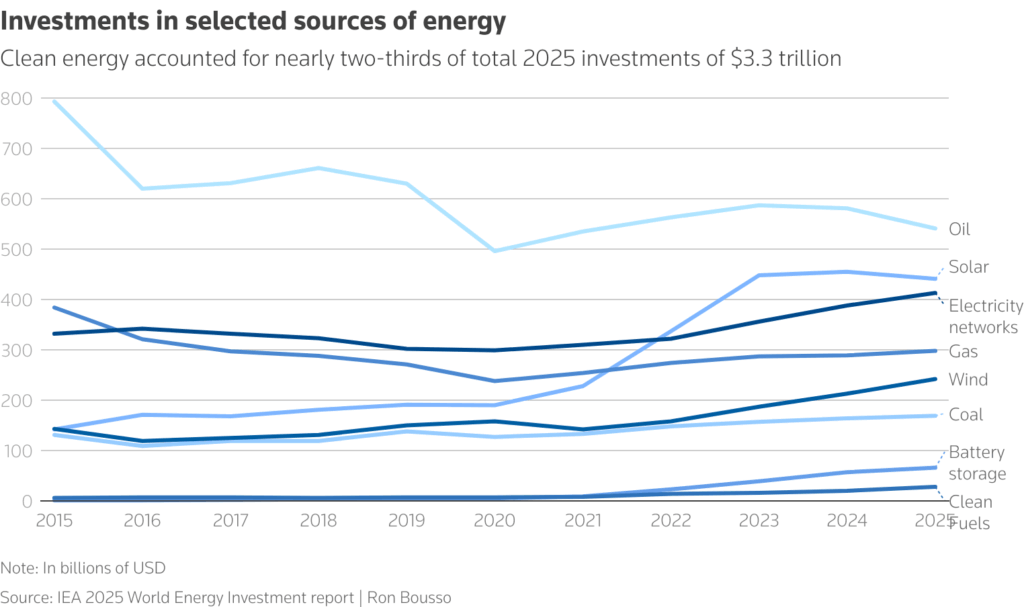

Investments in selected sources of energy

SPENDING IS BOOMING

So which scenario, CPS or STEPS, appears more likely?

STEPS is certainly better aligned with current spending patterns.

Spending on low-emissions power generation has almost doubled over the past five years. Out of a total of $3.3 trillion investments in energy in 2025, two-thirds are expected to go into renewables, nuclear, battery storage, low-carbon fuels and electrification, according to the IEA’s recent World Energy Investment 2025 report.

Solar remains the hottest renewable technology by far, with investment in utility-scale and rooftop solar panels expected to reach $450 billion in 2025, according to the IEA.

Investments of this scale are rapidly changing the global energy mix.

Global renewable power capacity is forecast to double between now and 2030, increasing by 4,600 gigawatts, roughly equivalent to the current combined power generation capacity of China, the European Union and Japan, according to the IEA’s Renewables 2025 report.

Unsurprisingly, some 70% of the increased spending is expected to come from countries that are net importers of fossil fuels, led by China and Europe.

China has been leading the clean energy revolution for years, putting it miles ahead of the rest of the world in terms of investment and deployment of renewables and EVs. Beijing is set to invest an eye-watering $630 billion in clean energy in 2025 alone, doubling the level ten years ago.

China also exports around $15 to $20 billion per month in clean energy equipment, 5% of its total exports and the equivalent, in dollar terms, of 12 million bpd of crude oil, according to Bernstein analysts.

Of course, the story is very different in the world’s other superpower. The United States is expected to see a sharp deceleration in renewables investment growth now that Trump has junked most of his predecessor’s clean energy policies. Even if a more climate-friendly administration comes into office, investors may hold back on ploughing cash into renewables given the volatile political and regulatory environment.

The rise of renewables

IGNORE THE NOISE

But, ultimately, even if the energy transition has not kept up with the expectations set ten years ago, the direction of travel remains clear, with massive global investment in renewables, batteries and low-carbon technologies .

While shifting to clean energy sources may require heavy spending to modernize grids and other infrastructure, clean energy sources have, in many cases, become more economical than incumbent fossil fuels, meaning the market may increasingly demand countries accelerate their adoption.

Investors would thus be right to ignore the political noise today and follow the financial signals of where the energy system is heading. While many may have overestimated the speed of the energy transition in the past decade, the danger now is that they make the opposite mistake moving forward.

Ron Bousso; Editing by Alexandra Hudson

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS